Introduction

Some of us may face financial burden at one point of our lives. From credit card bills to medical expenses, loans, and all the other things, just the thought of how to deal with it seems like being at the top of a huge mountain. No wonder, there are many who seek for practical ways to ease such financial burdens. Meet CuraDebt – a firm that has led a lot of people to stand on their own feet financially. On the other hand, a quite poignant question that keeps on coming to their minds is: Is CuraDebt granting a free debt diminishment program?

This article shall explore each of these, namely CuraDebt options, free courses, and tools to be used if you want to clear up your debt.

What Exactly is CuraDebt?

Who is CuraDebt? Let us first see that. Incorporated in the year 2000, CuraDebt is fast becoming a leading provider of debt relief services around the world. They concentrate on debt consolidations, tax debt resolution, including custom debt solutions suitable for both individuals and small businesses. For the time being, CuraDebt has achieved the goal of weakening the difficulties bringing high-interest debts with custom plans which make the process of repayment remarkably easy. Still, being customer-friendly does not mean that they offer all their services for free. However, CuraDebt is willing to provide you with the free consultation sessions and resources to direct you to the correct way to solve it.

So, Does CuraDebt Offer a Free Debt Relief Program?

Ah, the million-dollar question. The word “free” when it comes to debt relief is quite often the most important word. The simple answer is: Not entirely. CuraDebt doesn’t provide a “completely free” debt relief program in the traditional sense. Nevertheless, they do grace you with a free initial consultation which is indeed the greatest asset. The consultation allows you to go through a complete assessment of your financial condition and explore the various solutions that can be applied. It is a bit more than a quick drug history check; it is a full-blown session where CuraDebt professionals take in all your strengths and weaknesses and then they propose the most suitable interventions.

Key Features of CuraDebt’s Services

| Feature | Description |

| Free Consultation | A no-cost initial consultation to evaluate your debt and explore available relief options. |

| Debt Negotiation | A thorough process where CuraDebt negotiates with your creditors to reduce your overall debt. |

| Customized Plan | A personalized debt relief plan designed to meet your unique financial goals and budget. |

The free consultation is not just a dialogue, but a tool that enhances your understanding of your financial situation and helps you grasp what other options you have in getting back to the right track. It is a start that is worth without any initial fees.

How Does CuraDebt’s Debt Relief Program Work?

Now, you’re probably wondering, “What happens after the consultation?” For the purpose of clarity And I will describe the steps one by one. The process is not random but is intellectually based.

Initial Consultation: The first meeting is a stepping stone and is free. CuraDebt reviews your financial status and lets you know the solutions that might be appropriate for you.

Debt Analysis and Enrollment: Once you’ve determined the way forward, the CuraDebt team gets to the bottom of your debts and helps you to get into the program that is suitable for you.

Negotiation and Settlement: In this case, CuraDebt takes the reins and deals with the creditors on your behalf. The intention is to have a reduction of the total amount owed so the debt is more tolerable and the burden is relieved.

Debt Relief Plan Completion: Yet after negotiations you will still be making monthly deposits into a separate account, which will be used for the repayment of the negotiated debts.

This whole process often lasts between 24 and 48 months, depending on the size of the debt and your personal financial situation. Getting rid of insurmountable debt is a long-term commitment but one of the valuable benefits is being free from the overburdening pressure.

Table: Pros and Cons of CuraDebt’s Debt Relief Services

| Pros | Cons |

| Free consultation | Fees involved after enrollment |

| Reduces overall debt | Not all creditors may agree to settlements |

| Personalized debt relief plans | Potential short-term negative impact on credit score |

The Perks of CuraDebt’s Free Resources

Even though you will not be required to pay for the whole debt relief program, CuraDebt offers a couple of free tools that will help you to understand your financial situation. These resources are indeed a treasure chest for anyone who is really interested in studying how debt is accumulated and managed.

Free Debt Analysis: This preliminary analysis gives you an indication of your financial standing and also the possible solutions to your debt problems.

Educational Content: Through a variety of media, such as blogs or videos. CuraDebt aims at the very objective of educating their clients. You will get access to tips about everything from budgeting to debt consolidation.

Personalized Advice: Although one will pay for the complete debt relief program, the individual advice given during the consultation is invaluable and thus helps you to make educated decisions.

Explore the possibility of a free debt relief program with CuraDebt. Take the first step towards financial freedom and learn about your options now.

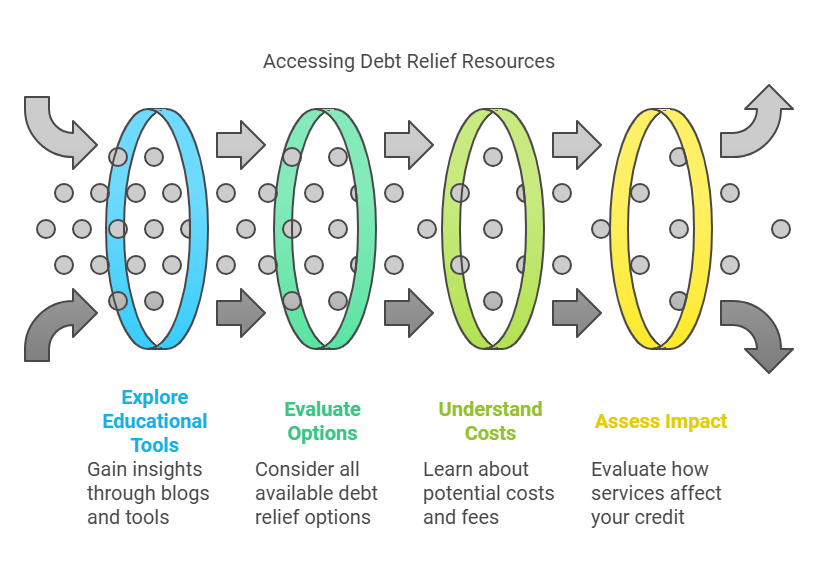

How to Access CuraDebt’s Free Resources

Schedule a Free Consultation: The initial step to access these incredible resources will be to book your free consultation. You can do it easily through their website or call their contact center. The simple process ensures that you will get your financial help sooner.

Explore Their Educational Tools: Entering CuraDebt’s blog & online tools will be the next step. The material contains a mountain of useful information that can not only facilitate your understanding of your financial situation, but also assist you to get a handle on your debt.

What Are Your Other Free Debt Relief Options?

CuraDebt, on one hand, offers many relevant benefits, but on the other hand, it would be smart to evaluate all options you have. Then, what other free debt relief options are there?

Credit Counseling Agencies: Some of the non-profit organizations provide free financial counseling services. Also, these agencies can help you design a debt management plan.

DIY Debt Management: Are you brave enough? You can ask your creditors for lower interest rates or for the payment plan to be adjusted.

Government Programs: The government makes available for free or at a low cost to the individuals who are eligible the Debt Relief programs.

Frequently Asked Questions about CuraDebt

1. Does CuraDebt offer any completely free services?

CuraDebt has a complimentary introductory session and educational materials. Meanwhile, their debt relief services cost money, which is most often levied after settlements.

2. How much does CuraDebt’s debt relief program cost?

The fees usually represent the percentage of the reduced amount of the debt settlement. These fees, however, are calculated based on the debt level and the complexity of the case.

3. Will participating in CuraDebt’s program hurt my credit score?

It is indeed true that your credit report will bear a hit temporarily. The point here is that the debt negotiation process nearly always includes stopping loan payments due to negotiations over the money owed by the creditors.

4. How long does the debt relief process take?

Most debt relief programs last between two and four years depending on the debt size and the client’s ability to pay monthly bills.

5. Does CuraDebt operate in all states?

CuraDebt does not function in every state. The only method is to log in to their website, or you may want to reach out directly to determine availabilities in your state.

Is CuraDebt the Right Choice for You?

The choice of a debt management firm to collaborate with (CuraDebt) hinges on your financial situation. The free consultation is a good platform to start, because it shows you whether their services are in line with your debt explainer goals. When you are in a huge amount of unsecured debt and that situation results in conflicts with creditors, CuraDebt may be your solution. On the other hand, if it’s a free solution you are looking for, you might seek alternatives like credit counseling and also you can negotiate with creditors on your own.

Conclusion

To sum up, although CuraDebt does not provide a full free debt relief program, they offer some extremely valuable services starting from free consultations to professionals who are able to drastically reduce your debt. As for the free resources which you can get through the web platform of CuraDebt, they will bestow you with the right knowledge regarding finance management such that you will know where to begin and what to do next.

However, being in debt is a move backward. Take the leap, sit down with a consultant, and get that first step out of the way. It may even be the beginning of your journey towards financial freedom.

Nevertheless, before you make the cash call on any institution, you should look at the whole gamut of opportunities.

No matter if you choose CuraDebt or a credit counseling agency or a government program, selecting a suitable way to achieving debt-free is of utmost meaning. You will be able to free yourself from the burden of debt with the help of the best-strategy advice and the personal attention from the experts and start your life from scratch.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.