When it comes to software for accounting, QuickBooks easily keeps its place among all the other solutions. It has been proven to be the most preferred tool by small and big companies, ranging from sole proprietorships to giant corporations.

What is it? Yes, you are correct. The potent characteristics, the beauty of simplicity, and the possibility to expand without limits altogether give it a huge advantage over competitors. If you are to be a bookkeeper for simple procedures or manage complex finances of an organization, QuickBooks has time-saving tools that will help you optimize your business, increase your output, and explore the quite detailed financial status of your business.

You will be shown the process from software installation to adapting its essential functions for effective financial management in this guide. By the time the Step you might even multiply the most of your banking account. business.

Table of Contents

Introduction to QuickBooks

QBKs, the invention of the company Intuit, has become a brand that every house recognizes in the software accounting industry. Are finances the main problem? The answer is yes. Don’t worry, handling your ithard-finance package that is very simple to express. It does not matter whether you are dealing with expenses, the payroll management system, or the reporting instrument, QuickBooks does it all efficiently, correctly, and you don’t even have to lift a finger.

QuickBooks is available in many versions just as several vehicles are produced to fulfill different customers’ needs. These include QuickBooks Online (cloud-based, it is very perfect for businesses that wish to have access to their data from anywhere), QuickBooks Desktop (best for more complex, industry specific needs like, construction, non-profit, professional services, and retailer accounting), and QuickBooks Self-Employed (targeted for freelancers). QuickBooks is the technology that you can leverage to make your finances run effortlessly for your business irrespective of the company’s size or type.

Key Features of QuickBooks

QuickBooks is not only making bookkeeping easy, it’s a strong and full platform for managing all aspects of your business finances. Let’s adopt a division of its best features:

Invoicing and Billing

Picture it getting you invoices in a blink of an eye. Just select a design, add the client details and click print. QuickBooks enables that and several other creative ideas that you might have. While using QuickBooks, you can easily personalize, and add your company logo in the templates or establish a schedule for billing. Additionally, you are capable of following overdue invoices and reminding the clients to cough up, so you will not have to chase payments.

Expense Tracking

Forget paper-based tracking in the past now. Linking your business bank account to QuickBooks allows it to automatically classify remarks, thereby enabling you to maintain your expenditures effectively and not miss any deductions. This helps to also have clear cash flow visibility in real time.

Financial Reporting

They are the most crucial element of a business. QuickBooks provides nearly every imaginable financial report including Profit & Loss (P&L) statements, Balance Sheets, & Cash Flow Statements, which, in turn, gives you all the vital information you need to make key decisions immediately.

Payroll Management

If your company employs people, QuickBooks can help you with that. It does everything from the manual payroll process of calculating wages, deductions, and taxes to the preparation of payslips and tax forms, thereby complying with federal, state, and local requirements.

Tax Preparation

Tax period is not the end of the world. Through QuickBooks, your income and expenses are so highly ordered that they are literally tax-ready. QuickBooks also has a feature that makes it very easy to transfer your data to TurboTax for tax filing.

Multi-User Access

In case of a multiple member organization, QuickBooks provides multi-user access with customized permissions. It doesn’t matter if you are giving full access to an accountant or you just need a part-time employee to view specific data, QuickBooks gives you the ability to decide what to show to whom.

Inventory Management

If you are a seller of physical goods, QuickBooks has comprehensive inventory management options. Maintain stock level records, prepare purchase orders, and keep an eye on inventory in real-time to see that you are not out of the crucial products.

Setting Up QuickBooks for Your Business

Do you really want to use the functionality of QuickBooks to the fullest? Then the configuration must be flawless at the very beginning.

Choose the Right Version of QuickBooks

It’s always better to check the version of QuickBooks that is most appropriate for your business before you dive into the setup process. First, find out which particular version of QuickBooks suits your business before you actually begin the setup process. For businesses that need remote access, the best one is QuickBooks Online, and for those with complex financial matters, the best one is QuickBooks Desktop. QuickBooks Self-Employed is the best, without any doubt, for freelancers.

Set Up Your Company Profile

After selecting the most suitable version, the following step is to enter the general information about your business. These details include the company name, address, tax ID, and industry. Reports, invoices, and other documents created in QuickBooks will be your data across.

Link Your Bank Accounts

With QuickBooks link your business bank account and credit card for better transaction process. This feature provides you with the ability to import your expenses and incomes, which will be then linked to your dashboard. Thus, this gives you a real-time view of your immediate cash flows and allows you to save time on manual data entry.

Customize Your Chart of Accounts

Your business comes with a basic chart of accounts, you may wish to change it according to your company’s requirements. Add new categories for income, expenses, assets, liabilities, and equity along with existing ones and make sure each transaction is allocated to the accurate account.

Master QuickBooks Accounting Software with our comprehensive tips. Elevate your financial management strategies and achieve greater efficiency in your business.

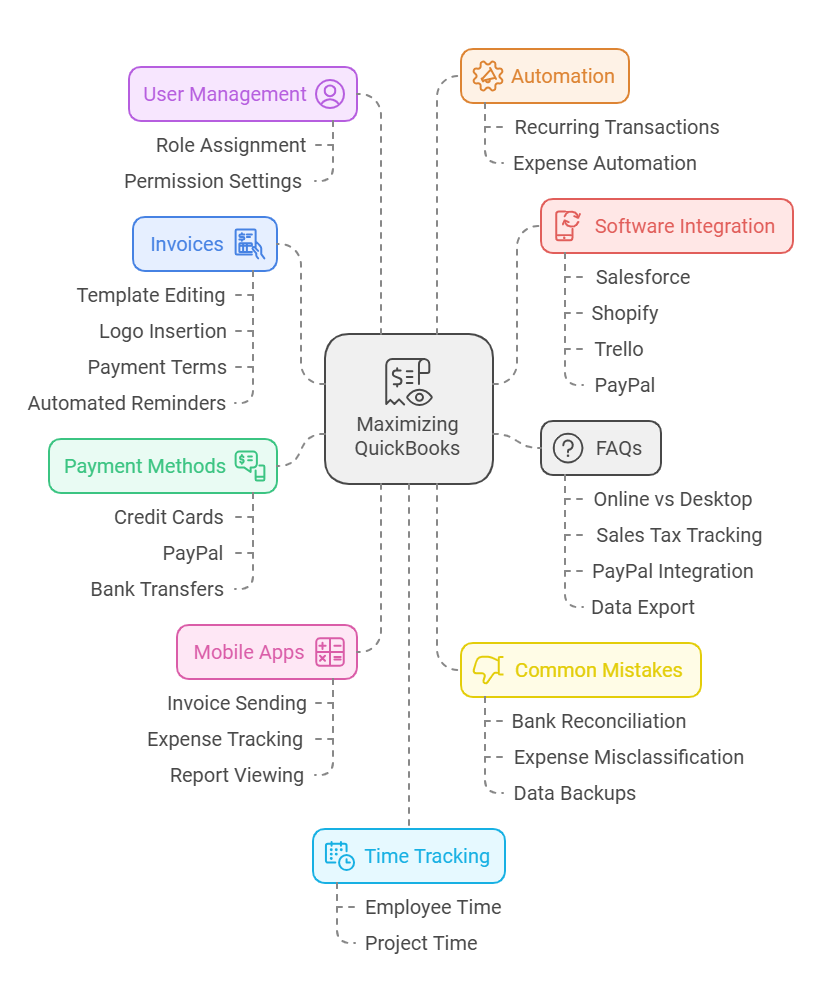

Set Up Payment Methods

QuickBooks gives you the convenience of receiving payments via credit cards, PayPal, and bank transfers which is one of the many advantages. When you set up different payment methods, you’ll be able to invoicing and receive payments hassle-free.

Create and Customize Invoices

Adding personal touches to the invoices is an absolute must when it comes to customer representation in an official capacity. QuickBooks lets you edit the templates, insert the logo, and arrange the payment terms, of course. Terms of payment are agreed upon by the supplier and the client. In addition, invoice reminders can be automated for the clients with overdue payments.

Assign Users and Set Permissions

If more than one team member is going to use QuickBooks, the distribution of user roles should be thorough. You can manage access to specific information; therefore, your accountant has full access, while others only have the data that apply to their role.

Maximizing Your QuickBooks Experience

Now that you’ve set up your QuickBooks, the next step is to harness its full potential. Here’s how:

Automate Recurring Transactions

Some expenses, such as rent or subscriptions, are inherent to human life. Instead of inputting them manually every time, design a recurring transaction in QuickBooks that will automatically be created on a regular basis. Automation eliminates your involvement in the process and also decreases the probability of memory lapse in paying a bill.

Leverage Time Tracking

QuickBooks is a time recording application for service-based businesses. When taking an account of employees’ working time or the period spent on a project, QuickBooks makes it possible to generate correct invoices by the application of the recorded time.

Use Budgets and Forecasting

QuickBooks is not confined to the mere recording of past financial data; it’s a great tool for planning and estimating purposes, as well. Apply the cash and forecast tools to predict forthcoming receipts and outlays, thereby assisting you in the decision-making process for your enterprise’s financial health.

Utilize Mobile Apps

The mobile apps for QuickBooks enable you to see your financial data even when you are away. Whether it be sending an invoice, tracking an expense, or viewing a report, the mobile application enables the managing of your business’s financial situation from anywhere.

Sync with Other Software

QuickBooks works in tandem with a number of third-party apps such as Salesforce, Shopify, Trello, and PayPal. The synchronicity of the QuickBooks with the already in-use programs will lessen the chances of duplication and keep every element centralized for better precision and efficacy.

Using QuickBooks for Financial Reporting

Financial reporting is involved in the most powerful features of QuickBooks. Just with a few clicks, you can draw comprehensive, customizable reports that show you the financial situation of your business. Here are a number of major reports:

| Report Type | Description |

| Profit and Loss (P&L) | Displays your income, expenses, and net profit or loss. |

| Balance Sheet | Shows your business’s assets, liabilities, and equity. |

| Cash Flow Statement | Tracks the inflow and outflow of cash over time. |

| Tax Summary Report | Provides a summary of your business’s tax obligations. |

| Accounts Receivable Aging | Helps track unpaid customer invoices and outstanding payments. |

To derive maximum benefit from these reports, it is necessary to make sure that your data is updated.

The process of reconciling & analyzing financial statements will provide you with actionable information about the health of your business.

Integrating QuickBooks with Other Software

QuickBooks is breathable. It offers seamless integration with other business tools, thereby making the operations management simple. The following are a few of the integrations that may help in the optimization of your workflow:

The above-mentioned integrations sync significant business data including sales details, customer information, and inventory among the platforms, thus, everything will remain in harmony without the need for manual updates.

Common Mistakes and How to Avoid Them

Though QuickBooks will take care of most of the accounting stuff automatically and considerably, it is still quite possible to make some of the very common blunders. Here is how you can avoid these:

Not Reconciling Bank Accounts Regularly

Reconciliation, the process of confirming that the accounts match the bank statements, is an essential part of preserving correctness. Set a certain date for a monthly reconciliation to make sure your documents are in line with your bank statement.

Misclassifying Expenses

A wrong categorization can render your report inaccurate and might even affect your tax returns. Regularly, make sure that all your accounts are classified correctly by checking the chart.

Neglecting Backups

In case you are utilizing QuickBooks Desktop, you should make sure you back up your data. A backup can be the savior in case of contingency if something goes South with your system.

Frequently Asked Questions ( FAQs)

Is QuickBooks Online better than QuickBooks Desktop?

In case it is important for a company’s business processes to be remote or mobile-viewable, QuickBooks Online is irreplaceable. For enterprises that have more complicated accounting issues like format specialty, the QuickBooks Desktop is the suitable alternative.

Can QuickBooks track sales tax?

Yes, QuickBooks is equipped with automated sales tax trackers and calculators that make the frightening procedure of tax filing over.

Can I integrate QuickBooks with PayPal?

Certainly. By connecting PayPal with QuickBooks, you will be able to record both payments and expenses through this feature and, in that way, accept eMoney.

How do I export data from QuickBooks?

You can make use of QuickBooks to export your data either to Excel or PDF, which is extremely convenient for you to share ,your reports or to save your finances out.

Conclusion

QuickBooks is a flexible accounts software that can be used for any business, small or large, simple or complicated, to facilitate the financial processes. By knowing and setting it up properly, you can utilize its capabilities & boost your business’s financial health.

Whether it be by automating the routine jobs or by the creation of reports and the sharing of the data with other programs, QuickBooks can become an irreplaceable part of your organization.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.