In today’s business reality that continuously changes, successful financial management is not a whim any longer, but is essential. Specifically, for small business owners, managing the income, outlays, taxes and payroll is frequently like holding up flaming clubs.

QuickBooks provides a strong solution that simplifies accounting tasks, making it easier to manage the complexities of financial management.

It’s widely recognized as one of the most trusted names in IT accounting software.

Already established in the market, QuickBooks, is both solo and business-oriented accounts management software that offers a wide range of tools for managing invoicing, payroll, taxes, and financial reporting. This all-inclusive manual will look into the features, benefits, and step-by-step process to help you get started with QuickBooks.

Table of Contents

1. What Exactly is QuickBooks?

QuickBooks, at its core, is accounting software that simplifies the process of managing your business’s finances.

Intuit’s QuickBooks provides a wide range of tools from the basic bookkeeping tasks such as tracking expenses & generating invoices to sophisticated operations like payroll management, tax preparation, & development of insightful financial reports.

Whether you use the desktop version or access it through the cloud with QuickBooks Online, the software quickly adjusts to your needs. In addition to merely organizing financial data, QuickBooks can be considered a lifeline for small businesses as it also helps to solve the problems of high time consumption and avoid errors in these processes.

2. Key Features Every Small Business Needs

QuickBooks presents many different services that help in finance management. Let us look at each of them separately.

Invoicing & Billing

Paying on time means that you are not late on your payments. QuickBooks is a great tool that lets you create professional invoices in a few clicks & send them directly to your clients. You can now see if your invoices are closed, in arrears, or even still pending and all in one area. Moreover, the automated reminders to follow up on late payments are a feature that saves you the time and pain.

Expense Tracking

Knowing where you are spending your money and responsibly handling it is not just good practice but being the essential part. QuickBooks is the tool that can automatically import bank and credit card transactions. These costs are immediately classified properly so that you have an intuitive and clear presentation of your budget, thus, easier detection of any idle spendings or areas where you could save.

Automatically sync transactions from your business accounts

Group and mark out expenses correctly when filing taxes

Scan receipts and upload them immediately into the system

Keep up with real-time cash flow

Payroll Management

For those employers who have their employees, QuickBooks Payroll is a real game changer. It simplifies the whole payroll process by calculating wages and deducting taxes, as well as by producing payroll reports. You do not need to worry about it. With QuickBooks, the payroll is running smoothly.

Setting up direct deposit for employee payments

Financial Reporting

Decision-making has become challenging for entrepreneurs due to the absence of reliable and updated information. QuickBooks actually provides an impressive selection of custom-generated reports such as the Balance Sheet, Cash Flow, profits and losses, etc. This enables you to obtain a decent insight into the financial status of your company.

Tax Management

Tax time no longer has to be a dreaded event. QuickBook is a great way to make tax time less stressful by automatically tracking your expenses and presenting you with the tools to produce the necessary tax forms, such as 1099s and W-2s. Its integration with the IRS makes it possible to e-file and pay the taxes through the software, which minimizes the errors and ensures your business compliance.

Unlock the full potential of QuickBooks with our ultimate guide for small business owners. Master your accounting tasks and drive your business success.

3. QuickBooks Pricing Plans: Finding the Best Fit for You

The main advantage of QuickBooks is that the different price plans are adjusted to meet the demands of different businesses. However, the real question that you should focus on is which of the two suits your business better.

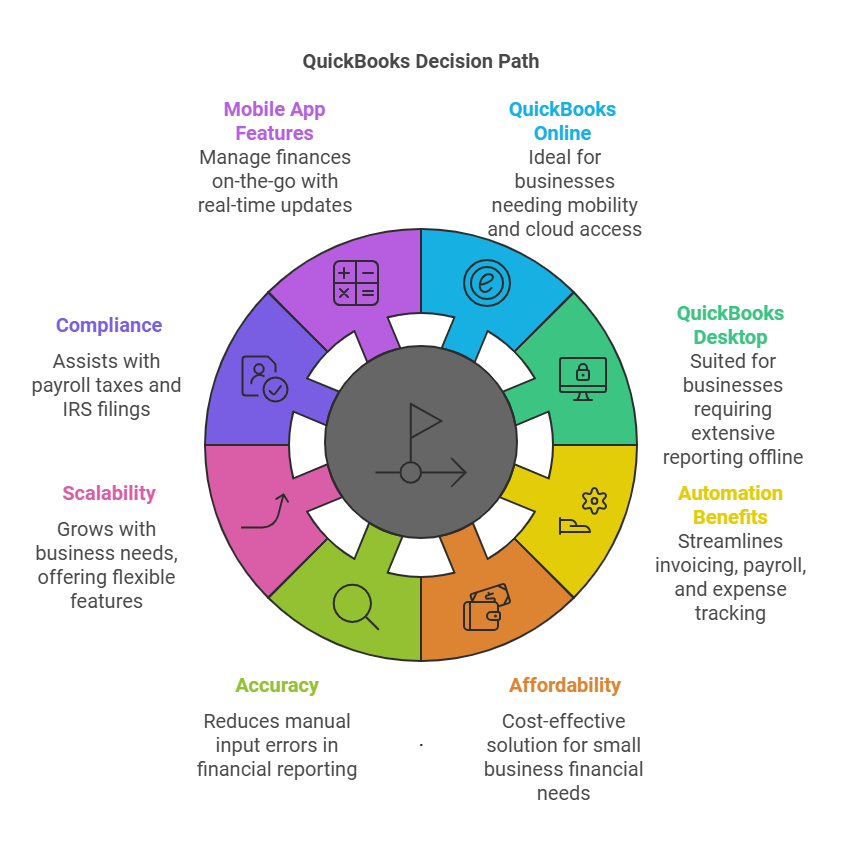

QuickBooks Online vs. Desktop

QuickBooks Online is a cloud-based platform that allows you to work from home or any other location you prefer. The latter is suitable for businesses that require constant flexibility and communication with accountants or employees working from distant locations.

However, QuickBooks Desktop is a conventional solution that is more personalized for small-scale businesses. A single PC is what is left after it is installed, which does not make it as mobile as the online version is. The knowledge is more substantial and it might be suitable for businesses that need extensive reporting capabilities and prefer working offline.

Comparing QuickBooks Plans: Which One Is Right For You?

Here is an overview of QuickBooks’ most popular plans for the users belonging to different industries:

| QuickBooks Plan | Price | Key Features |

| Simple Start | $25/month | Basic invoicing, expense tracking, tax deductions |

| Essentials | $50/month | Payroll, bill tracking, time tracking |

| Plus | $80/month | Inventory, projects, advanced reporting |

| Advanced | $180/month | Custom reporting, dedicated support, advanced features |

4. The Benefits of QuickBooks for Small Business Owners

No, that is not a surprise that QuickBooks has become the most popular program for small businesses. However, it is also quite a surprise.

Automation: QuickBooks takes over the simple docket line invoicing, calculates payroll, and tracks expenses. There are the before saved hours you could continue to avoid and put that energy elsewhere for growth.

Affordability: With plans that start as low as $25 per month, QuickBooks gives small businesses a cost-effective approach that gets rid of the need for expensive financial employees.

Accuracy: QuickBooks is a method to avoid manual input and human error. It enriches your data accuracy, which is the most important thing in financial reporting.

Scalability: Along with the increase in your results, QuickBooks is growing with you. The flexibility of the platform lets you do things like inventory management, custom reporting, and project tracking.

Compliance: From payroll taxes to IRS filings, QuickBooks is your best friend in this regard as it is your helper in a lawful environment and the thing that will make you avoid tax issues go the world.

5. How to Set Up QuickBooks

QuickBooks initiation is as easy as it can get, whether you own zero to a little accounting background. Here are simple instructions to follow:

Sign Up: The first thing is to find the plan that suits your business requirements and register on the QuickBooks website.

Enter Your Business Details: Populate the fields provided with your business name, industry, and tax information that will be used to establish the software to your desires.

Connect Bank Accounts: Set your business bank account and credit card you use to your business to automatic transaction syncing.

Customize Settings: Change the configurations of invoices, payment methods, and payroll to suit your business operations.

Start Managing: Everything from entering transactions to reporting the rest of the work lets QuickBooks take over from here.

6. Managing Finances on the Go with QuickBooks Mobile App

QuickBooks the desktop will not seem to be the end; with the use of the QuickBooks Mobile App, you have the power to manage your finances from anywhere you are. The application holds the capabilities you need regardless of where you happen to be be it at the office or the road.

QuickBooks mobile app is afforded on both IOS and Android devices which proves to be reliable to business owners who are constantly on the move.

7. Troubleshooting Common QuickBooks Issues

Even though QuickBooks is generally an accurate tool, the users can experience occasional technical issues. Let us take a look at a few of the common mistakes and the solutions:

Problem: “QuickBooks is not syncing with my bank account.”

Solution: Guarantee your bank account is perfectly connected by and look for any connection faults or maintenance notices from your bank.

Solution: Ensure that your bank account, is properly connected by and look for any connection faults or maintenance notices from your bank.

Problem: “Invoices are not showing up correctly.”

Solution: You should recheck your invoice settings and templates to determine whether they are well configured.

Solution: You should recheck your invoice settings and templates to determine whether they are well configured.

Problem: “Certain reports won’t generate.”

Solution: Make sure that your QuickBooks version is the one that you need to create the report. If you are using QuickBooks Desktop, you may need to upgrade it to get more reporting capabilities.

Solution: Make sure that your QuickBooks version is the one that you need to create the report. If you are using QuickBooks Desktop, you may need to upgrade it to get more reporting capabilities.

8. FAQs About QuickBooks for Small Businesses

Is QuickBooks easy for beginners?

Yup! QuickBooks is meant to be intuitive, especially for those who are not good in accounting. The setup is easy for you and the interface is user-friendly.

Can I file my taxes with QuickBooks?

Of course! QuickBooks not only keeps a record of tax-deductible expenses but also issues tax reports and lets you e-file via the software itself. Nevertheless, it is best to document the ideas that come up through brainstorming.

Can I manage multiple businesses in QuickBooks?

Sure! With QuickBooks Online, you can connect several businesses to one account, keep the finances of each one of them separate and structured.

9. Wrapping It All Up

Small business owners who want to streamline their financial operations should look no further than QuickBooks. With its powerful features, intuitive interface, and flexible payment options, QuickBooks can be your time-saver, error reducer, and business manager.

The nature and size of your company are irrelevant in this case, QuickBooks will help you to keep up with your business and grow it. Once you are ready to manage your business’s finances effectively, QuickBooks is your best solution.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.