Launching a business is a thrilling adventure and one of the very first decisions you are going to make is to decide on the legal structure for your company. One form of Limited Liability Company (LLC) is the most attractive choice in the United States. Why? Because an LLC gives the owner protection from any business loss, the opportunity to select different tax treatments, and a procedure which is simple to set.

This complete guideline will help you that how you can establish an LLC in the USA step by step, with the help of Swyft Filings, which is a well-known internet service company providing a one-window solution to form an LLC. At the conclusion of this article, you will be informed about the processes involved in the formation of an LLC and how you can go about doing it today.

An LLC, or Limited Liability Company, is a business structure that mix the best parts of a corporation with a partnership or sole proprietorship. An LLC provides liability protection to the members while at the same time allowing them to have the tax structure and operational flexibility they desire.

Often, an LLC is also easier to run in the corporate version, and it does not personally subject the members to the debts or liabilities of the company. Thus, for example, your home or car cannot be confiscated should your LLC be sued or face financial difficulties.

There are diverse advantages of forming an LLC, some of which are:

Personal Liability Protection: Members are not responsible for business debts or legal actions.

Tax Flexibility: LLCs are pass-through tax entities defaultly, which means that profits and losses are declared through the owners` personal tax returns. In addition, LLCs can choose to be taxed as a corporation if they wish to.

Operational Flexibility: LLCs are not as formal as corporations, and also have less record-keeping and reporting requirements.

Credibility: Creating an LLC can add steady revenues of a company with some financial risks, but it can make a business more credible and gain the trust of customers, investors, and financial institutions.

Creating an LLC is a direct process; however, it requires proper attention to the details. The necessary steps to create an LLC are as follows:

Before starting your LLC, one of the primary things would be the selection of an appropriate name according to the rules of the. The name of your business shall no:

Be different and not be already taken by another business in your state.

End it with an LLC identifier such as “LLC,” “L.L.C.,” or “Limited Liability Company.”

Not contain the words that are limited or banned by the state (e.g., “bank,” “insurance”).

After you have settled on a name, you may want to see if the domain name is available for your website and register it as soon as possible.

A registered agent is a person or business entity that will act as the main recipient of the legal papers and government notices of the LLC on your behalf. The agent of your company has to provide the address of the company and it has to receive the documents during working hours.

For those who are interested in being their registered agent, this can be an option but, alternatively, engaging business service such as Swyft Filings will handle the issue for you. Picking a professional agent will help you avoid missing out on important paperwork.

The Articles of Organization (also called a Certificate of Formation or Certificate of Organization in some states) is the official document you must file with the state to legally create your LLC. This document includes:

This filing usually requires a small fee, which varies by state.

Start your LLC in the USA today with our detailed guide. Swyft Filings provides expert assistance to help you navigate the formation process effortlessly.

Though not all states incorporate it into the requirement for having a business, we suggest it as a matter of good practice.

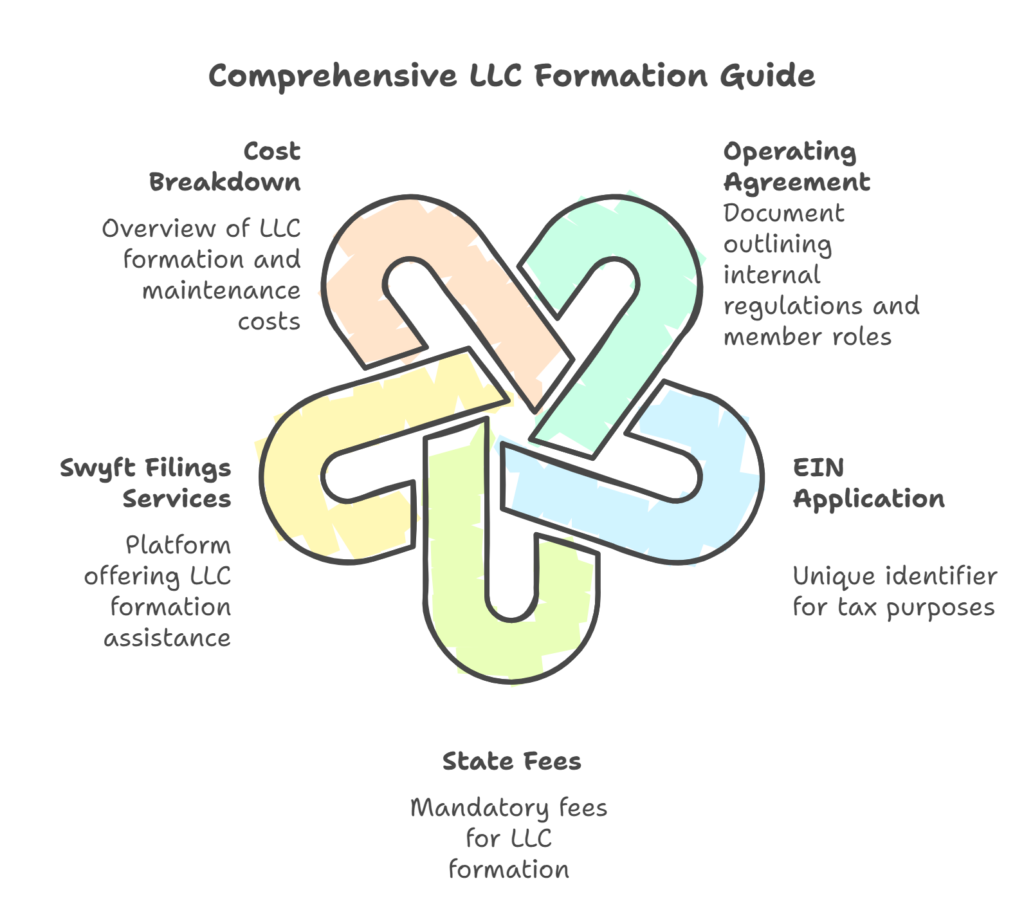

The document, which is necessary for the internal regulation of a company, contains the articles of organization as well as the operating agreement, which is the part with the organizational rules, decision-making process, and more. It can include:

An EIN is a unique number issued by the IRS to identify your business for tax purposes. It’s mandatory if your LLC has more than one member or if you plan to hire employees. You can apply for an EIN online for free through the IRS website.

If you are going to have a single-member LLC, you might not need an EIN unless you are going to hire employees or to be taxed as a corporation.

Every state imposes its own levy on the formation of LLCs. The tax rate varies from $50 to $500. The date when the Articles of Organization are supposed to be filed is also the date when these fees are due. There are some states that also require you to pay an annual non-tax transaction fee, the amount of which depends on the state.

Swyft Filings is a highly in-demand option for the establishment of LLCs. Their platform is easy to use and therefore easier for you to submit your papers in the quickest and easiest way, as it simplifies the LLC formation process.

To begin with the Swyft Filings, one needs to adhere to the following steps:

Go to Swyft Filings Website: On the Swyft Filings’ website, press “Start Your LLC” to continue the process.

Complete the LLC Formation Questionnaire: On the questionnaire, they ask for the things like business name, registered agent, and company address.

Choose Your LLC Package: Swyft Filings provides three packages from which you can choose: the most basic one consisting of only the LLC formation or other options such as EIN registration, operating agreements, or registered agent services.

Upon the accomplishment of the survey, Swyft Filings will prepare your Articles of Organization and will submit them to the state on your behalf. The procedure of the whole thing usually takes some days to a whole week-long time, but state processing times are sometimes faster than usual.

Such additional services are offered by Swyft Filings as well, among them being:

Registered Agent Services: Should you prefer not to act as your own registered agent, Swyft Filings can act as your registered agent for an annual fee.

EIN Application: If you are in need of an EIN, Swyft Filings will be in charge of acquiring one on your behalf.

Operating Agreement: Swyft Filings can create a professionally written operating agreement that best fits for your business scale.

Swyft Filings has a few packages provided for forming an LLC. Below is the quick clarification of one of their usual offerings:

| Package Name | Price | Services Included |

| Basic LLC Package | $49 | LLC Formation, Name Availability Check, Articles of Organization |

| Standard LLC Package | $149 | Everything in Basic + EIN Registration, Operating Agreement |

| Premium LLC Package | $299 | Everything in Standard + Registered Agent Service for 1 Year |

Note: Prices can be altered at any time; one should check Swyft Filings for the latest updates.

The formation cost of an LLC varies as to the state where you are establishing the LLC and the services you are buying.

Your state will charge fees from $50 to $500. If the state happens to be Delaware or Nevada, the rates will be lower, but if the state is California or New York, the rates are going to be higher. Check the exact filing fees on the Secretary of State website of your state.

Swyft Filings charge a service fee for LLC formation which differs based on the package you select. The agreed costs for any of these services are what you have seen in the table above.

Besides the initial formation fees, you should also allocate for common LLC maintenance costs which are:

State Annual Report Fees: To account for the filing of an annual report, one should budget additional money, about $20-500 depending.

Registered Agent Fees: If you are using Swyft Filings or another service, usually, the cost of a registered agent ranges between $100 and $300 per year.

A: No. Being a U.S. citizen is not required. Non-U.S. residents are able to create an LLC but they might need a U.S. address and must also apply for an

EIN.

A: Sure, you can make your own LLC online. Swyft Filings has a DIY feature too!

A: An LLC can be formed anywhere between several days to several weeks, depending on the state and how quickly the state processes your application.

A: In most of the cases, when we talk about LLCs, people should consider both the annual fee and the franchise tax in addition to the report.

The formation of an LLC in the USA is a brilliant idea for many entrepreneurs. It provides personal liability protection, tax savings, and a simple operational setting. Take the following steps and subscribe to services like Swyft Filings, and you will be able to make an LLC promptly and effectively. Whether you are working on a small part-time business or delving into a larger one, an LLC is great for sheltering your personal belongings as well as creating a marketable image.

The process is simplified and executed with the perfect support of the Swyft Filings team so that you can be 100% sure of the correct and professional set up of the LLC structure.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.