Starting a business in Texas is an adventure in its own right, but to get your business off the ground, you need the right banking partner.

Finding the best bank for your Small Business LLC in Texas is essential to streamline your financial operations and ensure smooth business growth.

In this article, we’ll discuss the top banks for LLCs in Texas, their features, and what to consider when opening a business account.

Your LLC, as a business, is in need of a specifically designated banking account that can toward fulling your financial needs. Whether it’s for the management of cash flows, loan applications, or the separation of your private and company expenses, a dependable bank will help you get them all. Texas, which is a key small business center, gives different banking options that are aimed at LLCs. Let’s assist in the choice process.

| Bank | Business Account Features |

| Chase Bank | Online and in-person banking, business credit cards, loans |

| Bank of America | 24/7 customer support, online tools, merchant services |

| Wells Fargo | Fraud protection, flexible loans, cash flow management tools |

| BBVA USA | Mobile banking, invoice management, business credit line |

| Citibank | International banking, online and mobile banking, credit options |

| Monthly Fees | Best For |

| $15 – $30 | LLCs looking for comprehensive services |

| $14.95 – $29.95 | Business owners who need extensive resources |

| $10 – $30 | LLCs with high transaction volume |

| $13 – $30 | Small business owners with simple needs |

| $0 – $30 | LLCs that need global payment solutions |

Business banking services offered by Chase for LLCs are widespread. Chase is a solid source of the most online and in-person resources, which means you have a broad base for an LLC to make the most of any financial situation. They are the best at offering accounts for businesses of all sizes, both with and without credit cards, and with flexibility towards mid-sized companies.

Business Checking Accounts: Zero monthly fees are charged in the first 60 days and after that paying fees may become a monthly occurrence depending on your balance.

Credit Cards: These accounts are a great way to save money and invest in your business. Small business credit cards that provide some kind of reward, and some, such as cash-back features, are examples of them.

Loans: The application of fast and convenient small business loans is the main focus, whether aiming to grow or obtain working capital.

Being one of the most developed and recognized banks of all time, Bank of America gives specific services to a company as legal as to the LLCs of Texas. Bank of America is a customer-focused bank, which is why they are continuously developing their customer service team. In addition to the 24-hour support, their infrastructure is not only built with the latest technologies but also serves companies in Texas in the best way possible.

Business Accounts: The bank provides companies with a flexible business account with charged fees depending on your balance and account activity.

Merchant Services: Put in one place, these The Merchandise Services of LLCs encompass web-based payment systems and point-of-sale with which to transact online and on-the-spot, respectively.

Business Loans: They offer a revolving line of credit on a flexible term loan basis, and lines of credit.

They offer products that are tailored to the particular needs of clients. They have a special package that includes such positives as savings, along with some practical advice and education materials for LLCs. It is best discovered by those merchants who are involved in voluminous transactions and those who are keen on availing of real fraud protection measures.

Cash Flow Management: Resources like invoicing, payroll, and accounting are the tools that LLCs have at their disposal to manage their revenue with ease.

Small Business Loans: For LLCs that want to scale their businesses, Wells Fargo offers a gamut of credit, term, and SBA loans.

Business Credit: Wells Fargo gives businesses the freedom to choose from business credit cards with cash-back, and travel points.

BBVA USA is a popular destination for small businesses that need modest banking services as well as it is a bank that allows the customers to carry out their banking matters without hindrance. The starting-out LLCs are by far the best in the market BBVA’s options.

Features of BBVA USA for LLCs:

Mobile Banking: BBVA’s mobile app is the most recommended choice for small business proprietors who travel a lot of places and have to get in touch with their accounts wherever they go all through the day.

Invoice Management: The bank offers the tools to help customers lower the time and hassle of accounting and billing, and to focus where they get the values the most: sales and customer service that they want to improve.

Business Credit Line: Provides access to a business line of credit.

Navigate the best banking options for small business LLCs in Texas with Swyftfilings. Empower your business with the right financial partner for success.

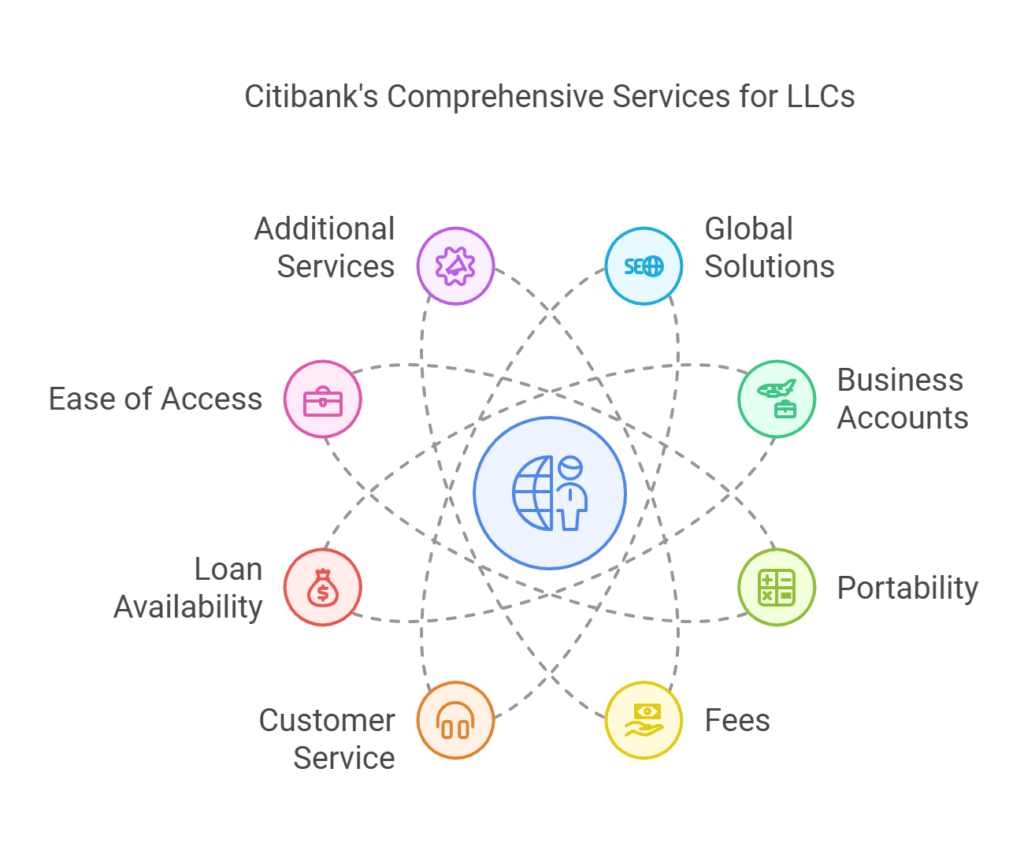

Among the leading organizations for transnational banking, Citibank stands out as the most suitable LLCs that require access to the worldwide market. They offer multicurrency accounts and foreign exchange services along with products for meeting international transaction requirements.

Global Solutions: Citibank is the choice of a few LLCs only, and offers these solutions that enable companies to start scaling abroad. The global platform creates the flexibility needed for these business ventures, regardless of the position they are in.

Business Accounts: One of the best deals for LLCs is to become a customer of a bank that has the strength to provide accounts for international operations, in this case, the global business checking account is a wonder.

Portability: A variety of methods for handling an international business account.

| Bank | Minimum Deposit | ATM Access |

| Chase Bank | $25 | Nationwide |

| Bank of America | $100 | Nationwide |

| Wells Fargo | $25 | Nationwide |

| BBVA USA | $25 | Nationwide |

| Citibank | $0 | Nationwide |

| Online Banking | Overdraft Protection | Credit Options |

| Yes | Yes | Yes |

| Yes | Yes | Yes |

| Yes | Yes | Yes |

| Yes | Yes | Yes |

| Yes | Yes | Yes |

Choosing the right bank involves a few of the essential points:

Fees: Look for banks with low or no fees for business accounts, especially if you’re a new LLC. Some banks offer fee waivers based on account balance or activity.

Customer Service: Excellent customer service is essential for resolving issues quickly. Most banks provide dedicated business support lines or relationship managers.

Loan Availability: If your business requires financing, make sure the bank has various loan products such as lines of credit or small business loans.

Ease of Access: Banks with good mobile apps, e-banking tools, and a network of ATMs will make it easier for you to access your money.

Additional Services: Some banks offer other services, besides the ones described, that help LLCs in managing their operations, such as payroll, merchant services, and invoicing tools.

Launching a bank account is a quick process, but you will have to present some fundamental documents. Here you go: The steps to open your LLC’s business account in Texas.

Choose Your Bank: Examine the banks mentioned above in detail and choose the one that suits your needs most ideally.

Prepare Your Documents: Collect all the necessary documents, such as the LLC formation documents, Employer Identification Number (EIN), operating agreement, and personal identification.

Open Your Account: Go to the bank in person and fill out the necessary form or you can even do it online.

Put In Your Deposit: Most banks insist on as little a deposit as $100 for opening the account.

Start Using Your Account: As soon as your account is ready, you should be ready to make transactions for your business needs. You can execute a transaction to your account. Once you have done all the steps above, and your account is good to go, use it for the business transactions.

A1: There is no single figure for the minimum deposit; it depends on the bank. To illustrate, Chase stipulates a $25 opening deposit for a business checking account, on the other hand, Citibank does not require a minimum deposit.

A2: No, to open a business account, your LLC is required to obtain an EIN (Employer Identification Number) tax ID number which can only be acquired from the IRS. This is the number you will be using when it is time for tax reporting.

A3: Keep in mind the possible charges associated with monthly account maintenance, fees for any transactions, and charges for services such as wire transfers and overdrafts for which the banks need a fee collection. Some banks offer no monthly maintenance fees as long as the account balance is maintained above a certain level; others offer free transfers if there is sufficient activity in the account.

A4: Certainly, some banks like Citibank provide free business checking accounts without monthly maintenance fees and likewise, some banks do not levy fees when certain account activities are performed.

A5: The process of getting a business account opened may take anything from a couple of minutes to a couple of days, as the bank’s policy might require you to bring documentation that you may be provided for or not.

One of the crucial things you should do about your LLC in Texas to keep your business money intact is to choose the best financial institution. All the banks that were earlier mentioned are good choices. They offer various business services and features that are particularly tailored to the needs of the small business owners. Hence, in view of the aspects of the charges, customer support, and the services are given to customers, you will be able to recognize the fitting bank for your LLC and who will endlessly profit in its activities.

Choosing the bank and account type, which are the most suitable to your business structure and your specific needs, will be the first step in running your company properly, allowing you to sign it up for success.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.