The Importance of Choosing the Right State for Your LLC

In times of initial capital generation, the decision to select the state that has the best conditions for establishing a Limited Liability Company (LLC) is the most important. While every state offers its own advantages, some states provide specific benefits that can save you money and hassle as your business grows.

The choice that can be underrated becomes a standout and a differentiator. Among the factors you can focus on are tax rates, business laws, or how easy a business can be included, and picking the right state can be crucial to your LLC’s performance.

This piece of writing will be focused on the reasons for the right state’s selection when forming a limited liability company as well as the factors to be taken into account while making your decision and how you can use Swyft Filings service online.

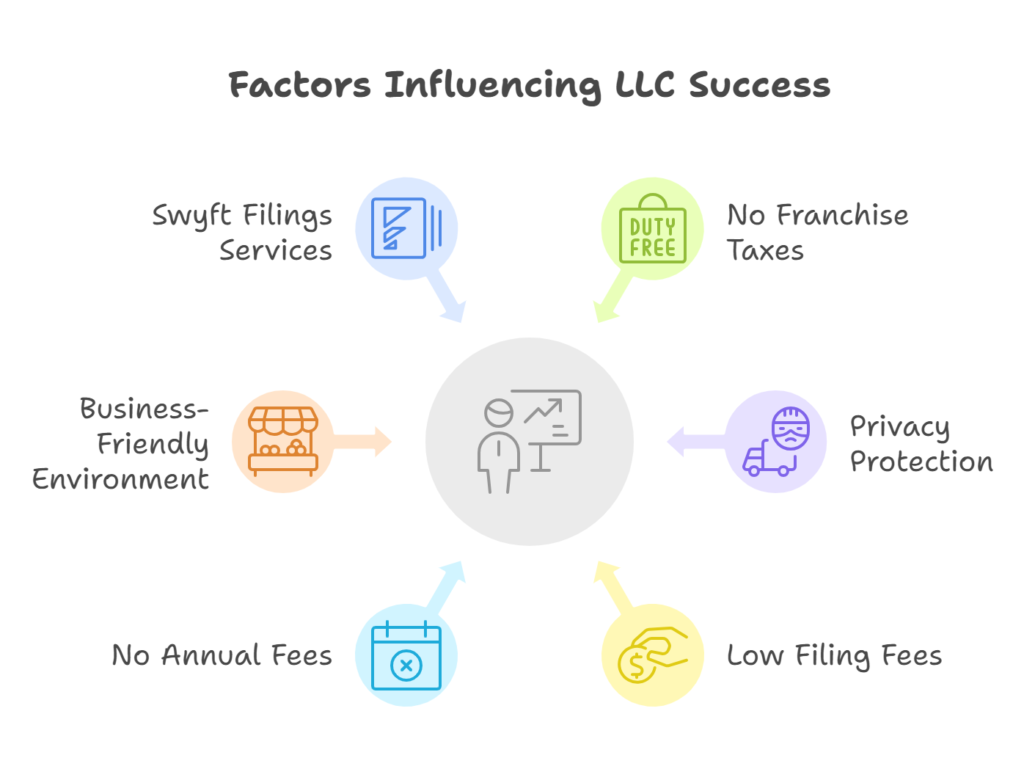

The choice of the right state for your LLC may have a direct influence on the financial health, growth prospects, and the duration of your enterprise. A wrong state can lead to more taxes, higher failure costs, & legal issues that can be avoided. A thorough understanding of the benefits and concerns involved with each state is key to making the right decision.

State Taxes: There are varied tax laws across different states. For instance, Delaware and Nevada are well-known to be business-friendly, especially with respect to the tax system.

State Fees: LLC formation cost differs from state to state, e.g., in some states, businesses can incorporate with no low/zero fees, while in others, fees can be high.

Legal Protections: Some states give more protections to business owners, such as right to privacy and limitation on liability.

Business-Friendly Environment: These states are known for being more entrepreneurial friendly through a quick and simple process, a less bureaucratic government, and through such things as tax incentives for startups new to the business.

Foreign LLCs: If you’re forming your LLC in one state but are planning to conduct business in another, you will need to consider the process of registering as a foreign LLC with that state.

Let’s explore these factors in more detail and observe the actual status for LLC establishment in some of the most popular states.

Some states are famous for being more friendly towards companies than others. Let’s take a look at the three topsilicones for business registration in the USA:

Delaware is claimed to be the leading state for LLC formation in the United States. The following is the chief reason for this:

Business Law and Court System: Delaware is reputed for its company-centered and legal environment. The state’s Court of Chancery is well-known for sorting out business conflicts fast and justly without going to the jury.

No Sales Tax: This state is known for its zero sales tax, which is one reason why business organizations consider it quite a tempting place to base their activities. This is particularly the case when it comes to online marketing of products or services.

Privacy Protections: Corporate owners also had the luxury of staying private under the Black Mask Law, which was most appealing to those who gave privacy the top priority.

Low Filing Fees: Even with the annual franchise taxes included, Delaware charges for LLC filing are still considered to be on the low side of the scale, with the state receiving $90 per annum in comparison to $200 in other states.

Nevada is familiarly known as a hot favorite among entrepreneurs for forming LLCs. Here are some of the benefits:

There is no tax on the state level: This is because Nevada is not a state that imposes a personal income tax;

Nevada, as well as Delaware, gives privacy protections that are similar in terms of how LLC owners can keep their business identity private without disclosing their names in public records;

Once a company is incorporated, the business is expected to comply with simple regulations enacted by Nevada state authorities who are responsible for the proper formation of the firms.

The strong asset protection law: Nevada, in particular, has strong liability protection measures in place which are highly favorable to those looking to open a business organization by ensuring the safety of their own properties.

Uncover the significance of the right state for your LLC formation. Swyft Filings assists you in identifying the best state for your entrepreneurial journey.

The state of Wyoming is often a hidden treasure for LLC formation. It has everything to offer that state Delaware and Nevada have but their prices are way more reasonable in comparison. Here’s why:

Low Fees: There are very low initial filing fees that Wyoming charges, actually, they are one of the lowest across the U.S.

No State Income Tax: As an LLC owner, Wyoming taxes from the state will not find you. So be happy.

Strong Privacy Protections: Wyoming is known for the great privacy rights it offers to LLC owners.

Asset Protection: Wyoming has developed strong asset protection rules to safeguard the property of small business owners from being taken away from them.

States Demonstrate Dynamics Two! In addition to Delaware, Nevada, and Wyoming is bright and shiny as to the gravity of the advantages of these states over others in the management of the business. Some states like South Dakota and Florida have tax liabilities and business-friendly environments, appealing to businesses for the same reasons.

| State | Formation Fees | Annual Fees |

| Delaware | Low | Low |

| Nevada | Low | Moderate |

| Wyoming | Very Low | Low |

| Florida | Moderate | Moderate |

| South Dakota | Low | Low |

| State Income Tax | Privacy Protections | Court System |

| No state income tax | High | Court of Chancery |

| No state income tax | High | Nevada Supreme Court |

| No state income tax | High | Wyoming State Courts |

| State income tax | Moderate | Florida State Courts |

| No state income tax | Moderate | South Dakota Courts |

State taxes can make or break your LLC’s balance sheet. As reported in Delaware, Nevada, and Wyoming, which actually does not charge state income taxes, spending less is most likely to save money for your business. Nevertheless, center states like California and New York have high state income taxes that would lead to you paying more taxes to do business as an LLC.

For the LLC formation, the primary filing fee can differ greatly from one state to the other. States like Delaware, Nevada, and Wyoming are all infamous for ridiculously high LLC filing charges. Moreover, you should also include the expenses of maintaining a LLC. There are those states who require annual fees or franchise taxes, while the rest do not.

“One such example is Delaware which provides the LLC owners with the best protection which is by far the most developed jurisdiction in the country,” said Hecht. However, there are better options. These bylaws may encompass improved confidentiality of LLC members, increased protection from personal liability, and more transparent legal procedures for solving corporate problems.

It should be noted that some states are adopting more simplified processes for filing and governing a Limited Liability Company. By putting in place systems that are recognized as effective by entities such as Wyoming, the company makes the process of creating and running a business as easy as possible, even for the most bureaucratic tasks.

Choosing the state for incorporating an LLC can be a complex decision.

However, Swyft Filings guides you through the process step by step, making it a more tolerable and faster process. They are the easiest to use and have the most professional team of advisors. It is therefore very simple for you to identify and buy a state that is exactly what you need of your business.

Expert Advice: Swyft Filings can help you in grasping the benefits and disadvantages of each state based on your business goals.

Simple LLC Filing: Complying with the LLC filing process can be difficult, but Swyft Filings has made it simple and without stress.

Ongoing Support: After the LLC has been registered, Swyft Filings offers continuous support to help you with your business needs, including annual report filings, and compliance requirements.

| State | Best For | Key Benefits |

| Delaware | Businesses seeking strong legal protections | Court of Chancery, no sales tax, business-friendly laws |

| Nevada | Businesses seeking tax advantages and privacy | No state income tax, strong privacy protections, asset protection |

| Wyoming | Budget-conscious LLC owners | Low fees, no state income tax, strong privacy protections |

| Florida | Businesses seeking easy access to markets | Moderate fees, no state income tax, growing market potential |

| South Dakota | Businesses focused on affordability | Low fees, no state income tax, business-friendly laws |

The best state for forming an LLC largely depends on your particular business needs. Delaware, Nevada, and Wyoming are most visited for their low fees, steadfast legal system, and data confidentiality.

No, you indeed do not have to incorporate your LLC in your state of residence. However, if you are going to transact business in a specific state, you may need to register your LLC as a foreign LLC in that state.

1. Delaware is notorious for its pro-business legal system characterized by the Court of Chancery, low filing fees, no state sales tax, and strong privacy protections that LLC owners enjoy.

They provide an incredibly easy to use service for LLC formation, where you get expert advice, and all the paperwork is handled for you, and you get continuous business support.

Choosing the right state to form your LLC is one of the most important decisions you will make when starting a business. By knowing what an important role such as state taxes, filing fees, legal protections, and business laws play in the decision, you will be able to pick the ideal state for your business. Swyft Filings is the company that makes it easy to incorporate your business and one that advises you at every stage.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.