One of the key moves that will make or break your business is deciding on the state in which to form your LLC. A good state will have a huge impact on the taxation affirmative, legal duties, and ongoing records at a company level. With a variety of choices available, it is paramount to figure out the states that bring the most benefits to your business type, location, and long-term plans.

This piece is dedicated to the top states to form an LLC in 2024 under the guidance of experts at Swyft Filings. Whether you are engaged in launching a home-based business that is also small or having plans for future scaling, such states will surely favor you by providing the right conditions to operate successfully.

An LLC is a type of business that offers personal liability protection, which means the entity is separated from the person so that the personal possessions of the owner are shielded from business debts or liability claims. An LLC is a top choice not only for solo entrepreneurs but also for other small-medium enterprises seeking heightened flexibility and security.

Not until we have a glimpse of a picture that you have the ability to analyze the topmost states in the United States, whether to register your business are we setting off on our exploration of the topic of the best states to start an LLC.

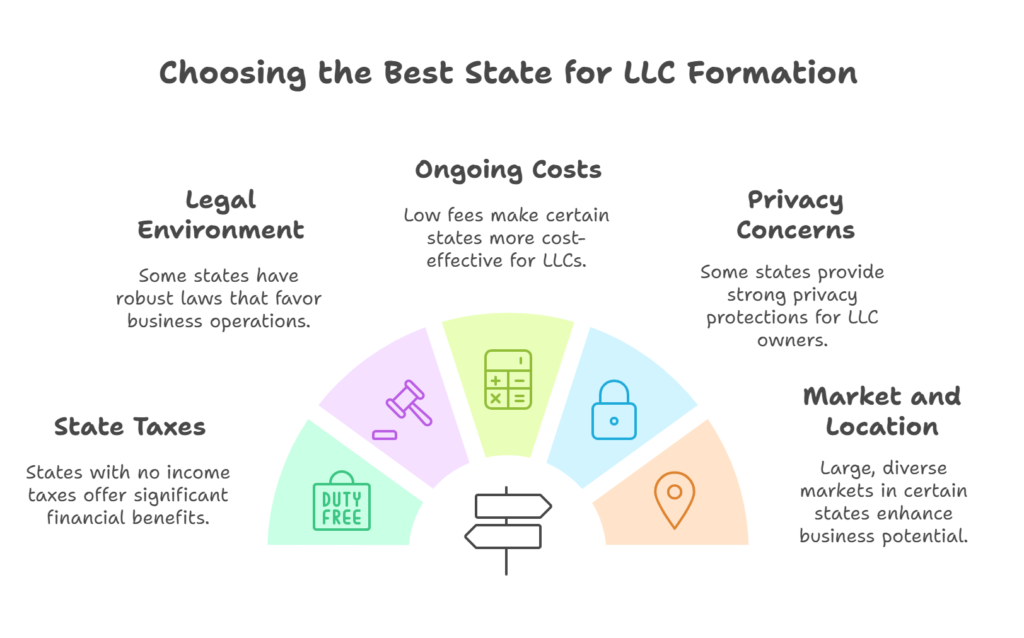

The choice of the state in which you decide to set up an LLC directly impacts a few critical aspects like:

Taxes: The business tax structures in various states differ from each other. In other words, some states have business-friendly tax conditions, for example, a state with no income tax, while other states might burden businesses with high business taxes.

Formation Fees and Ongoing Costs: Higher filing fees, annual fees, or franchise taxes in some states may escalate your business’s operational expenditures.

Privacy: LLC’s structure is such that in a few states, the LLC’s identity is hidden, meaning you can keep the name of the owners a secret.

Business-Friendly Environment: Some states can provide a more favorable business environment by adjusting the business laws and regulations thus giving businesses greater flexibility and reducing the bureaucratic red tape that often stifles them.

The Swyft Filings experts have identified that the states mentioned herein are the ones with the best business formations for reasons such as low cost, tax benefits, and simplicity of doing business:

Key Benefits:

No state income tax.Low filing fees and minimal ongoing fees.Strong privacy laws (you can form an LLC without disclosing the owners).Business-friendly regulatory environment.

No state income tax.

Wyoming is a solid pick for getting an LLC because it is one of the few states that doesn’t require a state income tax, having low fees and strict privacy laws. With the favorable laws for businesses, the regulatory landscape in the state is a perfect fit. Thus, it is the best option for small businesses and entrepreneurs.

Key Benefits:

No state income tax.No corporate income tax or franchise tax.Protection of LLC members’ privacy.Favorable business laws and no requirements to list directors or members.

Nevada is also a top pick among many entrepreneurs looking to set up a limited liability company (LLC), who may require tax benefits to be safely paid. The low level of state income taxes and the absence of franchise taxes are attributes of Nevada that are favorable to entrepreneurs who want to pay as little taxes as possible. Furthermore, the regulation in Nevada is also linked to the accessibility of the owners’ identities.

Key Benefits:

No sales tax on LLC services.Favorable for larger businesses due to established corporate laws.Efficient legal system for resolving business disputes.Internationally recognized as a business-friendly state.

Delaware has the great loose laws for the company the shield of which makes all companies to come after it. In addition to well-established corporate laws, Delaware is a location most suitable for big branches planning to raise capital or go public. Also, Delaware provides a friendly environment for LLCs due to its flexibility and ease of doing business.

Key Benefits:

A state with no income tax is among the lowest states in terms of cost of living and doing business and has a dynamic economy with a large market for new businesses.A business-friendly environment with many incentives.

Texas is a great state for businesses looking to establish themselves in a growing and dynamic market. The state’s lack of an income tax and its large and diverse economy make it a top choice for entrepreneurs. Whether you’re starting an LLC in the technology sector or in energy, Texas offers an attractive business environment.

Explore expert insights on the best states to establish your LLC. Swyft Filings provides essential tips for a successful business launch.

Key Benefits:

No state income tax.Strong economy and large consumer market.Business-friendly regulatory environment.Affordable filing fees and low ongoing costs.

Florida is ideal for entrepreneurs who want to start a business in a state with no income tax and low operating costs. The state is a hub for many industries, including tourism, technology, and healthcare, providing a diverse range of opportunities for new businesses.

Key Benefits:

There are no corporate income tax and no personal income tax if people live in such states. It is the most preferable state for forming and promoting an LLC due to the lowest cost, the best privacy laws.

South Dakota has flourished as the place of choice for business owners that want to save on taxes and keep corporate expenditures at a comfortable level. It has no corporate nor personal income tax and the apart from low LLC formation, and maintenance fees, it is among the states entrepreneurs can find most appealing.

It is designed and is considered by many to be the most secure way to ensure that one’s profits are not affected while taxes are kept as low as possible.

A comparison table that shows the most important features of the top states for LLC formation is presented below:

| State | No State Income Tax | LLC Formation Fees |

| Wyoming | Yes | $100 |

| Nevada | Yes | $425 |

| Delaware | No | $90 |

| Texas | Yes | $300 |

| Florida | Yes | $125 |

| South Dakota | Yes | $150 |

| Privacy Protection | Additional Benefits |

| High | Low filing fees, minimal ongoing costs. |

| High | No corporate income tax, no franchise tax. |

| Moderate | Internationally recognized, business-friendly laws. |

| Low | Large market, growing economy, low cost of living. |

| Low | Large consumer market, low cost of business operation. |

| High | No corporate or personal income tax, strong privacy. |

The process of picking the state in which one should form an LLC demands the review of various pertinent factors. Some key determining factors that will better inform your decision making process are as follows:

Tax issues have a significant influence on the choice of a state for forming an LLC. These states, including Wyoming, Nevada, and South Dakota, provide significant tax benefits such as no state income tax and no corporate income tax. Basically, these tax gains are being passed indirectly to your business, which can increase the bottom line.

LLC law varies for each state, but the state in which Delaware stands out is like no other through their business laws instituted with solid business rules which businesses benefit massively from while going for larger or more complex kinds of legal entity actually becoming a corporation with a number of advantages.

There are some states that might have a lower number of LLC and ongoing fees thus your company may find it relatively more cost-effective to be put up in and maintained in. Actually, Wyoming, Nevada, and South Dakota with their low fees have long been others’ favorites to be dedicated business bases.

If a person’s privacy is a problem or s/he doesn’t want to reveal much about him/her, then Wyoming, Nevada, and South Dakota may be the best places to move to. More specifically, the anonymity of owners or members of the LLC is treated with the utmost respect and no owner’s or director’s name has to be made public by the state which redirects you to withhold those details when registering a LLC.

The location is the deciding factor especially if your limited liability corporation locates its operations only in the home state. Texas and Florida are two states in the U.S. that have huge, diverse markets plus they have business-friendly environments that serve as catalyzers for new businesses.

Liberty to choose one of those states and form your LLC without any yearly company registration tax, rather less payable will help your business not only short-term but also long-term. However, it should be noted that you may need to register your LLC as a foreign LLC in that state if you only do transactions in your home state.

Ongoing costs comprise of annual franchise taxes, state filing fees, and other business expenses. States like Wyoming and Nevada have very little ongoing costs, whereas in others, such as Delaware, there may be fees for bigger companies.

Yes, the majority of states do allow non-residents to form an LLC, among them Wyoming, Nevada, and Delaware. You still will require a registered agent in the state where the LLC is formed.

States like Wyoming, Nevada, and South Dakota are the ones that implement strong privacy regulations that will protect LLC members. Thus, these states will not ask the owners for their names, hence, it will provide the businessman more confidentiality.

Your decision to choose the state in which you will form your LLC is an important decision that will affect the success of your business. Wyoming, Nevada, Delaware, and Texas are among the states that have no income tax and privacy laws are also very good.

The favorable legal frameworks these states offer are the other advantages. Thus, considering your definite business needs, tax preferences, and fiscal resources, the best option may become the right state for you to concentrate on your entrepreneurial voyage.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.