Small business owners face difficulties in finances, project management, and tax compliance. Moreover, they should be provided with efficient tools to start invoices, manage payroll, and be able to communicate with other systems, thus, the problem is bigger.

Under such circumstances, QuickBooks, a wheel in the machine of the world of accounting software, becomes the lighthouse guiding through the storm. QuickBooks will still be the first option for small businesses in 2024 worldwide.

But why? Let’s move on and see what are the reasons for its leadership, starting with its strong capabilities and the smarts design, and beyond.

A Closer Look at QuickBooks’ Features

The realm of accounting software is extremely competitive, where the companies all battle with various tools & techniques, despite it, QuickBooks has put out that their product is a comprehensive tools. Would you be so kind as to be a freelancer who, if asked, can brag about money management skills or an infant business needing them to give them detailed reports and accurate payroll? QuickBooks is the one. So what’s the big deal about it?

1. Effortless Invoicing

QuickBooks invoice production is really great. Once you have done only a few clicks, you will have smart, polished promotions that show the unique image of your business. The method gives you a chance for flexibility and you can easily do recurrent billings for your loyal clients, including you will receive reminders if you fail to pay on time.

They demonstrate the different functionalities of the feature. Some of them are:—Customizable Templates: Provides the template of an invoice, which can be aligned with the business theme; Recurring Billing: The client automatically gets billed quarterly; Payment Reminders: Invoicing gets automatically sent already to the clients who have overdue payments.—Online Payment Integration: Option to select Paypal, Stripe, etc. as an electronic payment method.

2. Tracking Expenses Made Simple

Expenses usually come as a great confusion in the form of receipts, invoices, and payments. QuickBooks turns it into simplicity by letting you categorize and track each and every one of them. Besides, it enables you to upload receipts instantly, it gets synced with your bank accounts automatically, thus, you can view your spending in real-time.

3. Smart Tax Management

It is tax season that can cause migraines to many small business owners; however, QuickBooks thinks differently. The application links and classifies costs into separate categories and offers the option to export them to the accountant. With its inbuilt tax calculators, you can record sales tax, and income tax, and track obligations, giving you enough time to be ready for the tax deadline.

4. Integrated Payroll Solutions

Payroll is just the kind of thing, if one tries to process it, they will end up dealing with the bulk of the administrative burden. QuickBooks stands on the platform of workers being paid and the taxes due are calculated automatically. Lastly, your trouble about manual filing is going away thanks to W-2 year-end forms being automatically generated.

5. Bank Integration for Effortless Reconciliation

The times of manual data input are far from today’s business reality. QuickBooks effortlessly integrates with your banks and credit card accounts. All the transactions are imported automatically therefore you can reconcile accounts and keep an eye on cash flow with no stress.

The Benefits of QuickBooks for Small Businesses

1. User-Friendly Design

QuickBooks is the right choice for both accountants and non-accountants. Its user-friendly interface gently guides the individuals through the details of the financial accounting system. The app, therefore, is not a hurdle for those who have not dealt with accounting in the past, as the just a simple and clear interface allows you to get things right from the beginning.

2. Scalability for Growth

Your business will change, and so will QuickBooks, to match the change. It doesn’t matter whether you have few people, or a big team, QuickBooks has a package tailored to you. When your business is growing and you need to move up to a better program, it is easy to do.

3. Real-Time Financial Insights

Real-time data brings you to make good decisions because every wrong move from incorrect information never leads you to the right path. The subtraction of profit from the income statement & the balance sheet- as well as the cash & flow statements, are all elements from which you can figure out the scenario that the company is running through. This helps you to recognize changes, cash in and out handling, and help faster in smart decision-making.

Uncover the reasons QuickBooks is the top choice for small business accounting in 2024. Optimize your financial processes and achieve greater success with ease.

4. Customer Support That Cares

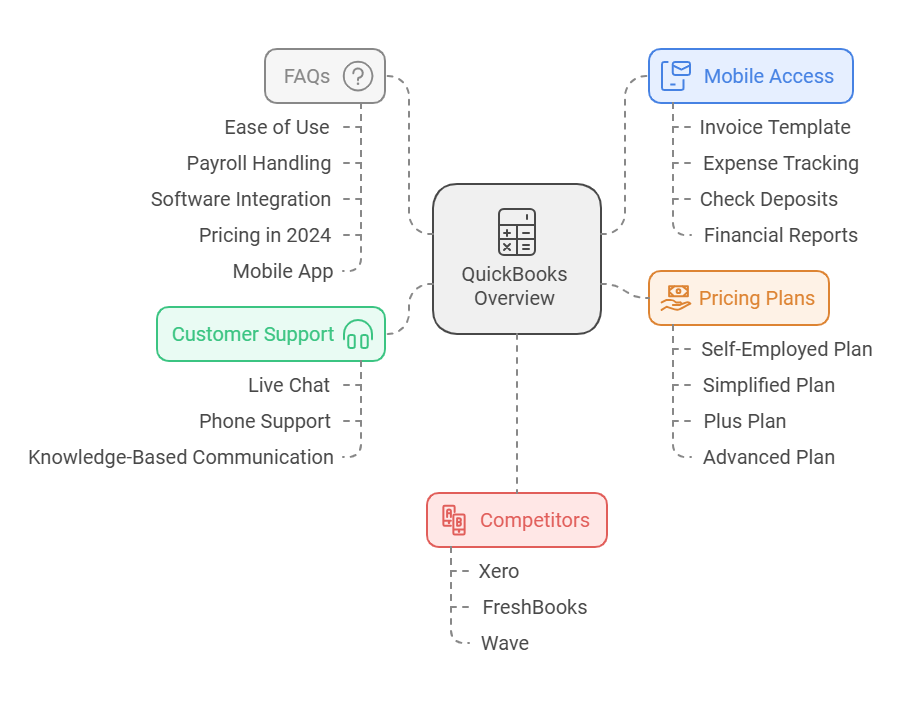

QuickBooks customer service is second to none, with several options that give you help whether via live chat, phone support, or knowledge-based communication. WhatsApp user, Don has any questions, or if he needs some troubleshooting, the people at WhatsApp are very friendly and will help.

5. Mobile Access, Anytime, Anywhere

Whether you are on your way to a meeting or sitting at home, Quitbooks mobile app will allow you to be in touch with your financial data. To replace the old invoice template, track your expences, deposit your checks and even view the financial report through the app on your smartphone. Thus you may monitor your corporate accounts even when you are on the move, which ensures you flexibility in your business operations.

QuickBooks Pricing Plans

QuickBooks offers different pricing plans all designed for various requirements and at different levels. Whether you’re just starting out as a freelancer or a small business, QuickBooks has a plan that’s perfect for you.

Self-Employed Plan

This plan specifically created for freelancers, allow’s you to easily keep track of incomes, expenses, & taxes. It’s appropriate in case you don’t have people who work for you or complicated accounting requirements.

| Feature | Self-Employed Plan |

| Income & Expense Tracking | Yes |

| Tax Calculation | Yes |

| Invoice Creation | Yes |

| 1099 E-filing | Yes |

| Price | $15/month |

This plan is, compared to the Self-Employed plan, a step up, therefore, it is the right choice for solo entrepreneurs. All you need from income and expense tracking to invoice generation comes in one simple package.

| Feature | Simple Start Plan |

| Income & Expense Tracking | Yes |

| Invoice Creation | Yes |

| Tax Calculation | Yes |

| Customizable Reporting | No |

| Price | $25/month |

The Plus Plan is a package for businesses that are scaling. Along with options such as project tracking and inventory management, it is meant for the rapidly developing companies which require their accounting software to do more.

| Feature | Plus Plan |

| Project Tracking | Yes |

| Inventory Management | Yes |

| Multi-User Support | Yes |

| Customizable Reports | Yes |

| Price | $50/month |

Advanced Plan

For a business that deals with the automation, reporting, and dedicated support, they should go for the Advanced plan. This plan suits large enterprises that need more powerful features and are craving for help from higher support.

| Feature | Advanced Plan |

| Custom User Permissions | Yes |

| Dedicated Account Support | Yes |

| Advanced Reporting | Yes |

| Price | $180/month |

QuickBooks vs. Competitors

QuickBooks has no direct rival offering the equivalent of features, ease of use, and scalability. There are, however, a few choices currently available. Here’s the way QuickBooks compares to the top several competitors:

| Feature | QuickBooks | FreshBooks |

| Invoicing | Yes | Yes |

| Expense Tracking | Yes | Yes |

| Tax Filing | Yes | No |

| Payroll | Yes | No |

| Customer Support | Excellent | Good |

| Price | $15-$180/month | $15-$50/month |

Despite the presence of competitors such as FreshBooks,and QuickBooks has the advantage of its rich functionalities and efficient support service.

Frequently Asked Questions (FAQ)

1. Is QuickBooks easy to use for non-accountants?

Yes, besides the user-friendly nature it is object oriented, learning no extra skills needed for even a layman.

2. Can QuickBooks handle payroll?

Definitely! QuickBooks processes each part of the payroll including payment, taxes, and year-end forms like W-2s automatically.

3. Does QuickBooks integrate with other software?

Yes, QuickBooks has third-party software integration including CRMs, payment processors, and e-commerce platforms.

4. How much does QuickBooks cost in 2024?

QuickBooks’ plans start from $15/month for the Self-Employed plan, and go up to $180/month for the Advanced plan, including several other options between the two.

5. Does QuickBooks offer a mobile app?

Yes, the wonderful mobile app that QuickBooks provides lets you take care of your company from anywhere.

Conclusion

In 2024 QuickBooks still manages to steal shows in the world of accounting software among the small businesses. Not only are its features outstanding, not to mention its scalability and ease of use, it makes it the top choice for entrepreneurs to handle financial management simply. If you are a freelancer or a business that is growing, QuickBooks has a full set of tools to help you record expenses, run payroll, and file your taxes. Not only does QuickBooks have competitive pricing but it also features fantastic customer service thus making it still the best accounting software up to date.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.