Starting a business in the United States is an exciting and rewarding venture, but it also carries some risks. For LLCs, there can be a business insurance that is the crucial protection measure to avoid the business being held accountable for any liability, financial loss, or legal issues.

The most important factor, whether you are just a small business or a successful and expanding LLC, is the reality that insurance is the main tool to the business’s durability and success.

This write-up will delve into the best small business insurance options for LLCs in the United States. We will delve into the different insurance coverages providers offer, the top insurers, and we will also present a guide on how to pick the best policy for your business. Besides accompanied with the detailed explanations, we will also include several convenient tables as well as the FAQ page to provide you with the most essential knowledge.

A Limited Liability Company (LLC) protects owners by putting a wall between their personal assets and LLC’s liabilities. However, it is safe to say, LLCs are not totally secure against both legal and financial liabilities. While LLC members are generally not liable for business debts of the company, they can still be made responsible for other reasons such as due to negligence, property damage, or injury to employees.

An LLC that is uninsured will possibly have a more serious financial problem, be at risk of higher legal expenses, and suffer a reputational blow that results in the business losing its life. This is the main cause that makes insurers safeguard against these kinds of risks and make sure the continuity of the business.

Different types of insurance are designed to the LLCs and are available and the ones that are best for your organization will be the ones that are tailored to your specific industry, operations, and risks. The following are the main kinds of small business insurances that an LLC could need:

General Liability Insurance plays a leading role in the offline activities of small corporate enterprises registered under LLCs. It includes claims of bodily injury, property harm, etc., that might happen in your premises or as a result of your business operations. If your business is accused of harming or damaging a client, this coverage will pay for all of the associated legal fees, settlements, and judgments.

Liability insurance is very important for companies that have physical sites, products, or services that are likely to cause damage or harm to their clients or other businesses. The problem of the gab is the carelessness of a D.V.N. driver is resulting in a three-car accident. Your customers pay you for delivering the goods not for caring about them.

Professional Liability Insurance (also called Errors and Omissions Insurance) is important for businesses that provide professional services or advice. If your business makes an error or omission in your work that results in a client’s financial loss, this insurance helps cover legal expenses and any compensation required to settle the case.

Professional service firms (e.g., consultants, accountants, architects, or medical staff) are the most vulnerable to lawsuits that claim their proposed solutions or the rendered service is the cause of injury or damage to some of their customers.

Workers’ Compensation Insurance is a necessary condition in most states if your business has employees. This care would be financed by the owner out of his business earnings or advances. The insurance will be the policy of senility. In exchange, employees give up their right to sue the company for negligence.

An LLC will have to pay a huge financial penalty if there are any workplace injuries and not having workers’ compensation insurance; it might also face legal issues for having insufficient coverage.

Commercial Property Insurance protects a business’s physical assets, such as its office, equipment, inventory, and buildings, from damage caused by events like fire, theft, or natural disasters.

If the instruments or the location is essential to the success of your firm, the last thing you would hear is that your insurance of this nature ensures the safety of your assets even in the event of such unforeseen events.

Secure your LLC with the best small business insurance in the USA from Swyft Filings. Get comprehensive protection and expert guidance for your venture.

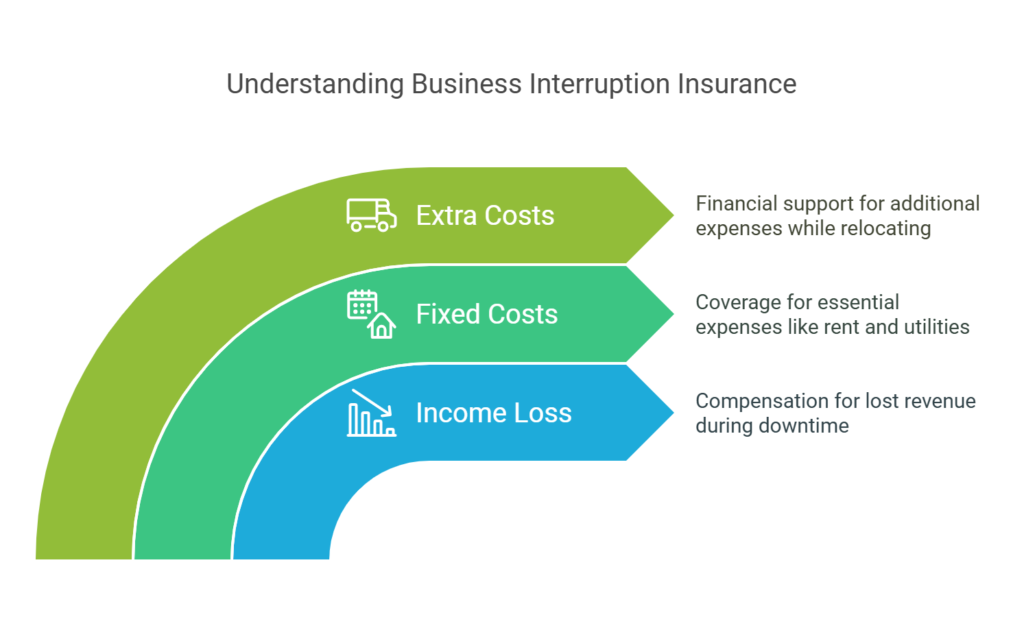

Business Interruption Insurance provides the loss of income coverage in the case of a temporary stoppage of the business activities that is insured under your policy, for example, fire, natural disasters. It covers ongoing expenses and the financial help needed to recover.

In case of a long-term business interruption, the insurance supports the company without any negative consequences like closing the doors to business forever.

After summarizing the types of insurance that LLCs need in our previous lecture, let’s now take a look at some of the most famous insurance providers dealing with small businesses.

Overview: The coverage provided by this company is not only inclusive; it is even more intensified when catering to small businesses. The institution designs their policies in a way that is appropriate to the different LLCs in question. This insurance company provides affordable rates, unbeatable service, and flexibility in terms of their coverage.

Overview: Hiscox, a veteran in offering insurance to small businesses and service-oriented businesses, is able to customized the policies. Apart from the quick approval and the shortness of the online applications, Hiscox is the preference for LLCs.

Overview: The advantage here is that Progressive provides affordable prices, and you are most likely to execute almost all the processes online easily. Their policies cover various sectors and, for your LLC, they could assist you in selecting the optimal one in real-time.

Overview: In the past, these insurance policies have been the choice of small entrepreneurial firms that claim its simplicity and inexpensiveness. In addition to the web-based solution, the clients could choose coverage either tailored to the kind of industries or general coverage in the case of. For instance, they could be the contractors, consultants, etc.

Overview: State Farm is one of the largest and most well-known insurance companies in the country. They offer various business insurance plans and have their agents to assist in differentiating your LLC’s coverage.

When it pertains to choosing insurance for your LLC, you must consider several critical factors to make sure that your business is well covered.

Know Your Risks: Identify the potential hazards to your business such as mishaps, lawsuits, or loss of property.

Get Quotes from Various Companies: Ask for price quotes from several companies to compare both prices and coverage.

Put Bundles Together: A lot of providers give discounts if you bundle several insurances such as general liability insurance and property insurance.

Check the Budget: Small ventures have different insurance needs considering size and industry. Make sure you select the policy that is within your financial reach while still being able to give you the necessary coverage.

Assisted by an Agent: If you remain indecisive about choosing your own coverage, a friendly conversation with an insurance agent can guide you in the best way.

The price of insurance for an LLC, in the beginning, can differ greatly according to the business’ size, its location, and the kind of insurance required. Nevertheless, as a rough estimate, the following will be:

| Insurance Type | Estimated Annual Cost |

| General Liability Insurance | $400 – $1,500 |

| Professional Liability Insurance | $500 – $3,000 |

| Workers’ Compensation Insurance | $0.75 per $100 of payroll |

| Commercial Property Insurance | $500 – $2,000 |

| Business Interruption Insurance | $500 – $1,500 |

It is important to check different sources and compare the quotes from different providers in order to find the best possible choice.

Although business insurance is not mandated by the federal government for LLCs, some kinds of insurance, for example, workers’ compensation, might be mandated by the states and the number of employees. General liability insurance is not obligatory but is desirable to have.

Yes, there are many insurance providers who offer discounts if you bundle different types of insurance with them, like general liability, property and workers’ compensation.

Think about your business type, size, industry, and the possible threats your business has to withstand. Talking to an insurance agent would probably be the best way to get an idea which coverage fits your needs.

The insurance cost is mainly relied on the type and size of your company. Typically, most small businesses can pay around

between $400 to $2,500 annuallу for various types of coveгage.

Yes, you can usually change insurance policies if your business grows or if your needs change. It is important to periodically review the insurance cover you have.

When the business is the LLC, the most important thing to do is to choose the proper business insurance tо оn the самое regarding the risks that could lead to a significant loss of property and income that would otherwise be painful and nasty. First step is to learn the differences in coverage and working with trustworthy insurance carriers, thus protecting your LLC from any disaster. Do not ignore the risk related to your company, get multiple deals, and ask for combined ones that will inflated the benefit of the deal.

You can effectively make decisions concerning your insurance needs and thus ensure the well-being of your company through the guidance in this article.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.