Debt is like the conservative politician of the modern era—in spirit, even in certainty.—that manages to develop an impenetrable grip on your life. Even if it is just a rising credit card balance, astronomical medical bills, or a heavy load of personal loans, it can make one feel like being buried under an avalanche. The good news is: you don’t have to carry that with you no more. There is a lifeline for you and it is not something you have to search for, it is the Curadebt Free Debt Relief Helpline. It transforms the unbearable nightmare into an outright reality, by helping people regain control of their finances one step at a time.

Debt doesn’t just touch your pocket; it invades your mental health, relations, and even your happiness. Happily Curadebt has been implementing real alternatives for more than 20 years. With a demonstrable record of success in debt resolution, this program has been the hope of those who feel trapped in a never-ending debt cycle.

What Exactly is the Curadebt Free Debt Relief Helpline?

Fancy the thought of talking to an understanding, certified expert who would guide you through thick and thin, over the phone? It is essentially what Curvedebt Free Debt Relief Helpline is—a direct line to experienced professionals whose expertise lies in strategy plans for debt relief including settlement to consolidation. Well, this is not a mere “customer service call.” This initial step could be your first path toward financial independence.

Curadebt is not like other companies in the industry, thus, it is not just another debt relief company. With over the years’ worth of experience, Curadebt has received positive feedback from its client and they are lowering their debts, resolving, & sometimes even getting rid of their debts completely. If your unpaid debt is in the thousands of dollars or tens of thousands, Curadebt’s professionals will sit with you in order to come up with a strategic plan apposite to your situation.

If for any reason you like to call the Curadebt toll-free number, then you are going to be met with a no-obligation free consultation. A real counselor in financial issues who will be assessing your situation, outlining the options that you have and the one that works as a solution will be available for communicating directly with you to tell you if you call the Curadebt representative. If you only owe a small amount of $5,000 for a credit card or must deal with the medical bills totaling $50,000, the Curadebt group is willing to assist you.

How Can the Curadebt Free Debt Relief Helpline Help You?

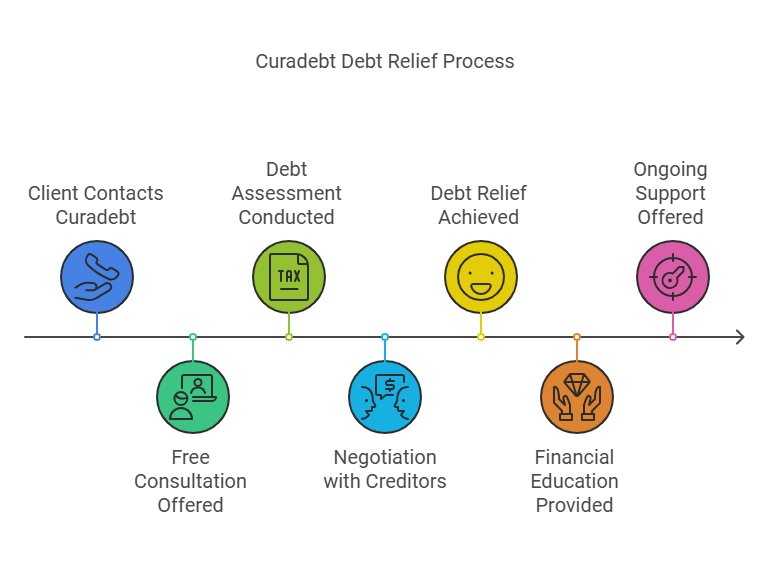

Would you be one of those committed to saying, how can a telephone call with the Curadebt team revolutionize my financial life? It’s not a spell, it’s a plan, guidelines as well as a personalized schedule that boosts your financial objectives to be on the top. This is how it works, check it out:

1. Free Consultation: Your First Step Toward Financial Freedom

The Curadebt Free Debt Relief Helpline starts with a free consultation that is your first step toward financial independence. Come and clear the air… we are not there to sell you anything. Rather we will dive deep into your financial condition. Are you struggling with credit card debts? Do you have medical bills that are past due? Are you having difficulty putting the minimum payments on them? You can face your anxieties here, while the Curadebt team stands by with their expert and compassionate approach.

During this consultation, you’ll gain insights into:

The full scope of your debt: To what extent do you owe? To whom have you been in debt? Is the interest rate high enough? These are the reasons for the actions that have to be done.

Your financial goals: What is your future that you have in mind? For example, would you like to pay off the debts of the loans or you want to reduce your monthly payments, Curadebt guides you through the process.

Options for relief: Is it possible for you to engage in debt settlement, credit counseling, or debt consolidation? The professionals at Curadebt show you all the possibilities and tell you the merits and demerits of each.

2. Tailored Debt Relief Plan: One Size Doesn’t Fit All

Every financial condition is different. Therefore, Curadebt, unlike other companies, does not provide products of the same size to everyone. They analyze the situation of your debt, income, and goals with great care to come up with a plan that is personalized and working for you. Whether you are a homeowner, renter, or have student loans, Curadebt designs the strategies that are customized and suitable for your situation.

Debt Settlement is a method of offering bundled deals to the creditors so that the total debt will be decreased. It is usually the case that, Curadebt can successfully reach settlements where you get to pay less than the full amount, thus easing the financial burden.

Credit Counseling: By means of their skilled counseling, Curadebt also offers tips on how to best manage debt, including budgeting, prioritizing payments, and lowering interest rates.

Debt Consolidation means that Curadebt may help you arrange different debts into a single payment that is easily controllable. This might be a method to decrease monthly payments and make your debts easier to handle.

Transform your financial situation with the Curadebt Free Debt Relief Helpline. Get expert guidance and support to manage your debt effectively and confidently.

3. Professional Debt Negotiation: Let the Experts Handle It

A lot of people find the prospect of talking to creditors about their debts to be over whelming. But Curadebt is the place where they excel. Their experienced negotiators are able to work with creditors to lower balances, reduce interest rates,& stop collection effort.

By letting Curadebt’s team negotiate on your behalf, you can relieve your anxiety and concentrate on repairing your financial future.

4. Long-Term Financial Health: More Than Just Debt Relief

Curadebt’s main objective is not only to help you get out of the debt trap it is to make sure that you don’t fall into the pit again. Through their financial education services, you, as an individual, are empowered with the right skills and tools that you will use to manage your finances in the future. In the end, getting out of debt is not a sprint but a marathon.

A Closer Look: Debt Relief Services Offered by Curadebt

Let’s go further. Here’s a detailed overview of the debt relief services that Curadebt provides:

| Debt Relief Service | Description | When to Use |

| Debt Settlement | Negotiate with creditors to reduce the total debt owed. | Ideal if you have a significant amount of unsecured debt (credit cards, medical bills). |

| Credit Counseling | Develop a plan to manage debt, reduce interest rates, and avoid late payments. | Suitable for individuals struggling to make minimum payments or needing help with budgeting. |

| Debt Consolidation | Combine multiple debts into a single, lower-interest loan or payment plan. | Best for those who want a simpler way to manage several debts and reduce monthly payments. |

| Bankruptcy Assistance | Guide you through the bankruptcy process, if necessary. | A last resort for individuals unable to make progress with other debt relief options. |

The Benefits of the Curadebt Free Debt Relief Helpline

Why should you trust Curadebt with your financial future? Here’s why:

Proven Track Record: In their business established over twenty years ago, Curadebt has been there and seen that, thus helping so many people eliminate their debts and rebuild themselves even financially.

Certified Experts: Curadebt’s debt relief experts are certified to bring, you solutions tailored to your specific case and based on their strong years of experience. They also make sure to clear the fog of any confusion you might have so you could make informed decisions.

No Hidden Fees: It’s free initially to the booking of consultations, hence Curadebt acts transparent on the costs of the services provided and thus, no surprises will arise.

Ongoing Support: As long as your debt is settled, Curadebt still continues to give you positive guidance towards your desired direction.

FAQs About the Curadebt Free Debt Relief Helpline

Q1: How much does it cost to use the Curadebt Free Debt Relief Helpline?

A1: Beyond the first discussion, which is intentionally free of charge, Curadebt will definitely be clear about all the costs they are hiding and you will not have any extra fees.

Q2: What types of debt does Curadebt help with?

A2: Debt maintained through credit cards, medical bills, personal loans, unsecured debts, and most others are manageable by Curadebt. They come up with individualized solutions for clients who find themselves in diverse debt situations.

Q3: How long does it take to resolve my debt with Curadebt?

A3: The timeframe is coordinated with the amount and the kind of debt that is. Some clients promptly get the relief they need in just 12 to 24 months, while others need more time as per the severity of their issue.

Q4: Will Curadebt affect my credit score?

A4: Debt settlement and consolidation could be affected by your credit score but the aim is to cut down debt to a level that you can handle which in turn, could be a benefit to your financial health in the long run.

Q5: Is Curadebt a trustworthy company?

A5: Completely. Curadebt has been in the business for more than two decades and their group consists of professional experts who are dedicated to making you financially free.

Final Thoughts:

Take Control of Your Financial Future with Curadebt

Debt might seem like an impassable mountain; however, the Curadebt Free Debt Relief Helpline has made it manageable. From congenial sessions to trained brokers and lifelong lesson in financial education, Curadebt provides the tools needed to escape the shackles of money and start living again.

Don’t just sit and wait for the situation to worsen—get to the phone and start the first move toward debt-free life now.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.