Introduction

Godlike money demands have come to haunt you along the road, as if time itself depends on them. The frightfulness of these demands can turn our lives into jungle wars of anxiety How will I ever manage to pay my payment problems and still have my everyday life? Whatever it is whether credit cards, loans, medical accounts as well as personal debts it seems you spend more time straining to remain current with the dues than anything else. You became mindful of the unending questions – Does salvation exist or not?

Yes, it does. Now the solution comes! Jessica is a worthy of hope in the midst of the economic slump. Their Free Debt Relief Program, a lifesaver, is specifically designed for clients in dire financial stints – which highlight the relief you don’t worry about paying a pinhead. Are you curious to know how it works? Come along for this déjeuner message as it possibly transforms you into an economic finisher.

So, What Exactly Is Curadebt?

Think of a firm whose mission is to eliminate your debt, and they do that by focusing their services on debt removal. In terms of Curadebt, their entry to Debt Oceans was marked in 2000. As time marched on they interact’ed and worked with individuals and businesses alike in debt handling. With them, it is either an air of joy, credit cards, medical charges, and loans that are sourced from what could be more secure financing. Experiencing incredible financial liberty.

Curadebt’s free Debt Relief Program gives every person a chance to manage his or her debts without the elaboration of the technique using already proven relief methods and including no upfront fees. Those who have felt it is like a circle of suffering in life, shall acquire this program as a key step for having.

How Does Curadebt’s Free Debt Relief Program Work?

The thought of debt relief is nice, but how does one really eliminate it? The Curadebt Free Debt Relief Program is not a universal remedy – it is specifically designed to meet your particular needs. Here’s how the process unfolds:

Step 1: Free Consultation and Financial Assessment

The first step is to an entirely free consultation where a debt relief expert from Curadebt conducts an in-depth conversation about your financial situation. They’ll be able to look at your entire debt balance, income, and outgoing to understand how much financial trouble you’re in. This deep analysis évotes à prolônged and thereby, you are approved by the program and what the best approach is for you.

Step 2: A Customized Debt Relief Plan

Once your case is clearly understood, Curadebt comes up with a plan bespoke to your individual needs. Here the aim is to cut down the amount of the debt that you have to pay, though this can be done in different ways-growth the debt, transfer of the debt or even involving credit counseling. Each plan is well-tailored to fit what you can afford and make sure that the process doesn’t become too much for you.

Step 3: Negotiating With Creditors

In fact, Curadebt’s professional negotiators take your documents and speak with your creditors in person in an aim to reduce the debt you’ll have to pay back. They will hire smart and experienced negotiators to do the negotiations with your creditors. Curadebt’s experience and relationships with creditors guarantee the client settlements that most people would be unable to obtain directly. The result is that you pay less than what you originally owed.

Step 4: Debt Settlement and Payment

After a settlement has been secured, the subsequent action is just simple: payments. Curadebt dedicates a particular savings account to the purpose of receiving your payments. They’ll make sure that every little thing goes right, keeping a dialogue with your deadlines to make sure that the agreement is being met continuously. It comes with the benefit of settling your debt at a sum that is lesser by far than the original amount.

Step 5: Ongoing Support

Curadebt does not rain you at the last few meters of the race. Their service extends beyond the actual period of the resolution, hence they provide constant support, making sure you stick to the program. This direction is fundamental for those people who may end up being overstressed by the entire debt management process. By way of addition, Curadebt covers beneficial monetary education at the same time, thereby enabling you to develop the habits that will keep you debt-free later on.

Explore Curadebt’s Free Debt Relief Program, offering personalized solutions to help you manage and eliminate debt effectively. Take control of your finances now.

Why Choose Curadebt’s Free Debt Relief Program?

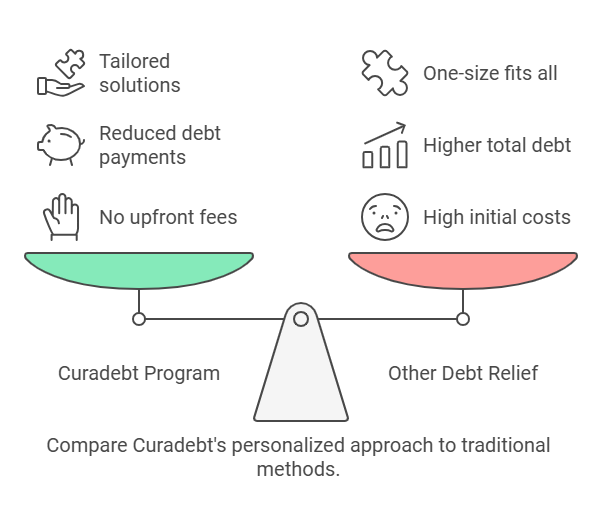

The competition is far from over on the paying-off debts scene, but Curadebt offers advantages of its own making its program a cut above the rest. Here may be the right reasons for you to choose it:

1. No Upfront Fees

You have been reading well—there’s no upfront cost. Debt relief firms sometimes demand high fees even before you set off, but Curadebt removes that problem. Instead, you can test the waters with a cost-free consultation and only continue your journey when it makes sense financially.

2. Reduced Debt Payments

Negotiation does wonders when Curadebt brings down the total debt you owe to creditors. You can pay off everything you owe while at the same time, you’ll enjoy the proportionate cut in your debt and thus you will have more to spare.

3. Tailored Debt Solutions

No two people have the same financial situations. Curadebt is not inclined towards providing one-size fits all solutions. Rather, they develop customized debt relief plans especially for your unique situation. If you are looking for debt settlement or credit counseling, their program will allow you to change it to suit your condition.

4. Expert Negotiation

Negotiating debt is not an easy process, but Curadebt professionals have the experience and skills to talk with creditors. Through long-lasting relationships and tactic-based negotiation, they shall work with you figuring out the best deal for you.

5. Continuous Support

Getting out of debts is not always an easy route. Therefore, Curadebt offers great depth of support in every aspect from beginning to end. From the first meeting to final discussion, you will get the unnecessary guidance of the prompts, and answers of quiz and questions when needed.

Comparing Debt Relief Strategies: Which One is Right for You?

It can be a daunting task to choose the apt debt relief option, but it is necessary to know the available options to you. Here is a comparison of the most commonly used methods of debt relief:

| Debt Relief Option | Description |

| Debt Settlement | Negotiating with creditors to pay less than owed. |

| Debt Consolidation | Combining debts into one loan or payment. |

| Credit Counseling | Working with a counselor to create a repayment plan. |

| Pros | Cons |

| Significant debt reduction, one-time settlement. | Impact on credit score, potential tax consequences. |

| Simplified payments, lower interest rates. | May not reduce debt, could extend repayment. |

| Budgeting tools, financial education. | Doesn’t reduce debt, requires long-term commitment. |

Which One Should You Choose?

But if your primary purpose is to lessen the amount of debt you owe, the debt relief option is probably the best choice. But if you are saddled with a lot of high-interest loans, then debt consolidation could be your most suitable option. Credit counseling, on the contrary, is specifically for the ones who do not want to reduce the overall amount of their debt but instead create a plan to manage the debt through a structured approach.

FAQ About Curadebt’s Free Debt Relief Program

1. How much does it cost to enroll in Curadebt’s program?

The initial consultation with Curadebt is free. There are no introductory expenses connected with the program. Your payments start immediately after you enroll your cogent and clear plan with the creditors and the payments commence.

2. How quickly will I see results?

The time frame for result’s depend on your specific situation, however, many clients start to see some improvement within the first year. In general, the period is between two and four years depending on the debt complexity.

3. Will my credit score be affected?

Debt settlement services like Curadebt potentially can take a short-term toll on your credit score as creditors report that you paid back an amount below the owed amount. But, in the long run, because you have cleared your debts, your credit score will be positively impacted.

4. Is Curadebt a trustworthy company?

Yes. Curadebt is a long-standing company with more than two decades of experience. Curadebt is a BBB-accredited firm that is competent service and reliable in the market as reflected through the many reviews that have been posted by satisfied customers who have used their services.

5. Can I use Curadebt’s program if I have secured debt (e.g., a mortgage or car loan)?

The Curadebt program targets unsecured debts such as credit cards and personal loans. Nevertheless, they may also be able to help you find other solutions to secure debt.

Conclusion

Being in debt is like being thrown into a whirlpool the Curadebt Free Debt Relief Program can be your lifesaver. Through its no upfront fee structure, skilled in negotiating, & tailor-made solutions, it provides a straightforward way out of a financial crisis. Curadebt is not only your company in resolving your debt issues, but they also represent you in every situation. Set Up A Free Consultation, & begin your journey towards a debt-free life.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.