One of the accounting tools that has gained massive recognition and usage is the Intuit´s QuickBooks Software across the entire planet. Whether he/she is a freelancer or accountant, QuickBooks is a factor in the efficiency, simplicity, and power of a business no matter the size. QuickBooks is constructed not only to control funds but also to fulfill the entire accounting system, which is a boon for those who quiver at the thought of spreadsheets, taxes, and infinite paperwork.

QuickBooks provides solutions for different types of requirements between startups, growing companies, and established companies. You’ll be able to manage your finances in accordance with your individual business plans such as through QuickBooks’s tools that enhance professionalism by enabling transparency and uniformity, and thus reducing errors to the barest minimum.

In this article, we will probe the top five QuikBooks features of Intuit Accounting Software that won it the appeal of every size of business. We also will cover some pressing issues with the help of a fascinating FAQ section and compare QuickBooks with its competitors in two tables.

1. Automated Bookkeeping: Making Accounting Effortless

The majority of such entrepreneurs may find bookkeeping somewhat cumbersome. The endless running of expenses and the assurance that everything is cleared up at the end of the month can appear as a never-ending commitment. Automatic bookkeeping in QuickBooks acts as a substitute for that situation.

Just think about this: There will be no longer every single transaction input, nor will be having sweaty palms because of credit card statements not being in order. QuickBooks takes the weight off you by automatically hooking up with your bank accounts and credit cards to keep your records straight, up-to-date, and without you having to intervene at all. It is the equivalent of having the best accountant at your disposal 24/7 but without paying him/her.

This is the reason the automated bookkeeping service offered by QuickBooks is so important:

Bank Account Integration: QuickBooks integrates with over a thousand banks and financial institutions thereby making your job of uploading and categorizing the transactions more effortless. This level of automation provides countless hours that could have been spent entering the data manually.

Smart Categorization: It is not all that is available from downloading transactions. QuickBooks automatically classifies them, thus eliminating the probability of human error. The only thing left to you is to review and confirm.

Effortless Reconciliation: The process of reconciliation has never been simpler before. QuickBooks uses complex transactions-matching-downloaded-to-your-records algorithms to spot any inconsistencies so you can resolve them in no time at all.

Instant Access to Real-Time Data: QuickBooks is a cloud-based system meaning your data is always on the up-to-date end, and it delivers the insights in real-time making it possible to make instantaneous decisions.

Therefore, QuickBooks does exactly that: it automates such troublesome and laborious little things, which by default are very time-consuming and prone to errors, thus it gives you the security that you never went wrong by being specific and up-to-date.

2. Advanced Reporting and Insights: Know Your Financial Pulse

Business people must be aware of their financial health. Becoming a successful enterprise does not matter without evidence of financial literacy. However, this could be hard for small business owners to achieve because they lack the right tools. QuickBooks officers the best way to advanced reporting which traditionally has just the basics as the main content. It not only gives a report but also gives directions and hints on how this company can be in the future.

The power of QuickBooks lies in the depth and flexibility of its reporting system:

Customizable Reports for Every Need: You need only basic balance sheets, profit and loss statements, and cash flow reports and QuickBooks determines the same with functionality that can be built into the system in accordance with the specific needs of your business. You can also select the date range, include or exclude data points and produce reports that give you a clear view of your financial performance.

Real-Time Dashboards: At your fingertips, QuickBooks offers you on-the-go access to your business performance graph anytime. Impression Revenue, Claim Expense details, Profit Margin analysis, you have all this on just one click, well, actually just a glance at the two features that display these. Reports at the end of the month are no longer necessary, do you want to read your dashboards and see the status of your real-time decisions?

Project Profitability Tracking: Do you care how much money you are actually making from your customers on a certain project? QuickBooks delivers that to you. It further measures the profitability of your account on a project-by-project basis, thereby enabling your discovery of productive areas in your office and those that maybe need some extra help.

Automated Financial Reporting: You not only have the on-demand generation of reports, but QuickBooks can also mechanize the process. Reports can be sent along with a time-table to you on a weekly, monthly, or quarterly basis. Maintaining awareness of funding does not need to be cumbersome when Daily, Weekly, or Monthly Report is set up appropriately.

For business people, these things are not just numbers – they depend on them in the project of success.

Uncover the top 5 features of Intuit QuickBooks Accounting Software designed to simplify your accounting tasks and improve your overall business performance.

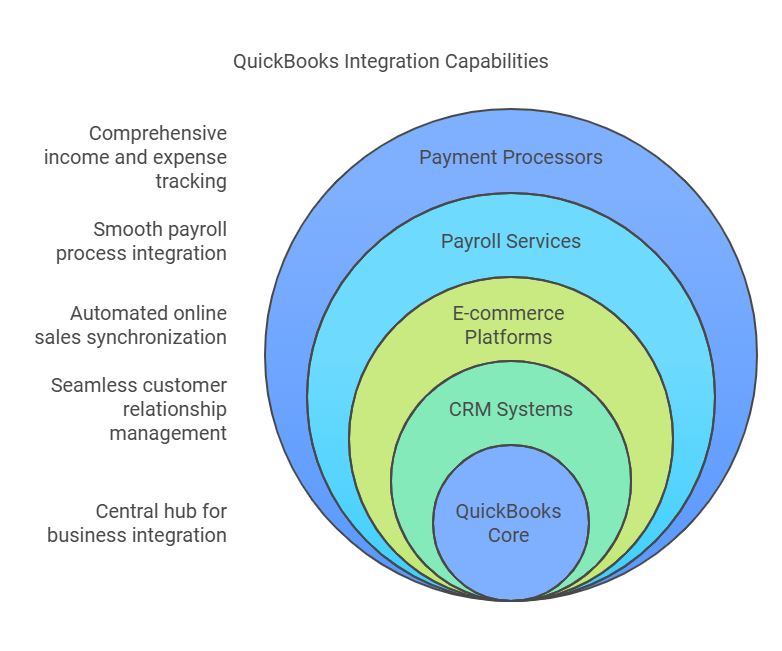

3. Integration Capabilities: Syncing Your Tools Seamlessly

The software’s capability for integration with other applications is one of the features that distinguishes QuickBooks. Running a business is not often done all by oneself. You probably use some other solutions, which may be either CRM, payroll, payments, or e-commerce. QuickBooks links you to over 650 third-party vendors, thus you get rid of the multiple applications mistakes and save yourself from manually transferring data.

If QuickBooks is the main point of your company’s financial functions, it will be able to connect with:

CRM Systems: Are you using a CRM system? Salesforce, HubSpot, and others seamlessly link with QuickBooks so you have all the info about your customers and financials in one place.

E-commerce Platforms: Having problems with running a web store? QuickBooks integrates with well-known tools like Shopify, WooCommerce, and Amazon to automatically synchronize the sales, inventory, and financial data.

Payroll Services: For companies with employees, QuickBooks permits payroll processes that are smooth and free of errors with Gusto-type services.

Payment processors: The QuickBooks accounting software is able to sync data from payment processors such as PayPal, Stripe, and Square, thus offering a comprehensive overview of all your income and expenses which simplifies the tracking process.

Banking integration: Do you hate the tedious manual entry of bank transactions? QuickBooks simply makes it happen that your bank, credit card, and other financial accounts get synced into the software, with the result that every one of them is perfect with the others.

These out-of-the-box features help you by cutting down your administrative workload, they get rid of data entry errors, and all your systems are in harmony.

4. User-Friendly Interface: Made Simple Accounting

The term simplicity should not mean that we cannot get strong and powerful, but QuickBooks delivers a clean interface that is easy to use and to master. It is powerful enough to aid you in complex accounting tasks like payroll. At the same time, it has a clear, user-friendly look. In other words, you need no rocket science degree to handle it. The software is also a great choice for beginners as it offers step-by-step guidance through the whole accounting process from setting up a new company to making a sale. One of the reasons why this software has become so popular is that it makes accounting accessible even for people who have no experience in handling crucial business transactions.

QuickBooks offers:

Guided setup: It is capable of preventing you from being lost. QuickBooks literally takes you by the hand and guides you through the whole process, so after a while, you will get it working at the speed of light.

Drag-and-drop simplicity: Do you want to create invoices or generate reports? Your QuickBooks will perform the task with a simple operation as the fact of dragging and dropping necessary data. Everything has been made to be intuitive.

Mobile access: QuickBooks has a companion version that is a mobile app that means you can use your phone or tablet to look up the latest data anytime day’s night. Your figure is one of the accounting teams and you have the team in your pocket.

Multi-user collaboration: Regardless of the fact, you are alone or with a team, QuickBooks allows many users to work together and each of them has a different permission level according to the role they are playing.

Adjustable Dashboards: QuickBooks is your master by allowing you to control your dashboard, guarantee that you can, without hesitation, uncover the financial information that is most important to your enterprise.

Auto Tax Calculations: In fact, QuickBooks does the math for you, by calculating your sales tax, payroll tax, and other taxes based on your locality and income.

Straight Tax Filing: Forget the long journey to the accountant’s office. QuickBooks makes it possible to do both federal and state tax filing directly thus costing you no time and money at all.

Super-Boosted Deductions: QuickBooks organizes your expenditures for you so you can maximize them and thus make sure you do not overlook possible tax savings.

Tax Law Compliance: The tax environment, on the other hand, keeps on changing. QuickBooks remains up-to-date with the recent tax law changes, so you don’t have any reason to worry about keeping up with the new regulations.

What Can someone with no accounting experience use QuickBooks?

Definitely! QuickBooks has a simple-to-use interface that is even easy for non-accountants to operate.

Is QuickBooks good for tax filing?

Of course, QuickBooks is one of the best software that reduces the filing of taxes by automatically computing the tax and also linking it to tax services. But, if it is a complex case, a tax expert might still be required.

Can multiple users work on QuickBooks at once?

Yes, QuickBooks grants multiple users, with each having different levels of rights, to access the system.

Is there a free version of QuickBooks?

QuickBooks offers a free 30-day trial, which after the trial you have to choose a paid plan.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.