It’s a great fun and adventure to start your business, it comes with a lot of choices, one of which is the location you decide to choose your Limited Liability Company (LLC). The states that you want to register your LLCs with is the most critical decision you will have to make.

With the huge variety of places available, it is crucial to be aware of the advantages and disadvantages of each state for the entrepreneurs. Swyft Filings, a well-known online LLC filing service, is very affordable and straightforward in its approach.

In this article, we will go through the states that are best for LLC formation and take a look at the ways through which Swyft Filings can help you maximize your business potential.

The choice of the place to establish your LLC has a long-term effect on your business. The one you select will determine many things such as taxes, legal requirements, and the difficulty of your LLC maintenance. When it comes to the state of your LLC, it is crucial to weigh the issues of cost, conditions facing business improvement, and the tax structure.

Taxes: Each state has a different tax structure. While some states do not have an income tax, others offer very attractive tax incentives for companies.

Fees: Each state charges different filing fees and annual maintenance fees for LLCs. These costs must be part of your decision making process.

Business-friendly Space: Some states have created the right environment with policies that support the development of the private sector, which can be seen as the key factor to boosting the economy in the region.

Legitimate Protection: Delaware and Nevada are the best states for LLCs, they are good at keeping the business regulations simple and business owner’s rights secure.

After the business idea becomes a reality, choosing the right place to register an LLC will be the most important decision. It’s time to get a closer view of some of the best states for LLC formation.

Delaware is one of the states known to be the most excellent environments in terms of business registration and operations. The option to turn on the suitable jurisdiction is not limited, and it is adopted by both the big and small companies. The jurisdiction operates a specialized legal body called the Delaware Court of Chancery, which is very efficient in resolving business disputes; this is the perfect combination of features that entice businesses and entrepreneurs.

No Sales Tax: No sales tax in Delaware makes the state a top choice for businesses.

No State Income Tax on LLCs: Regardless of the place of your LLC registration, Delaware imposes no state income taxes on the profits from the commercial operations.

Fast Processing: Delaware is most often noted for its unusually rapid registration of LLCs, sometimes within just a few days.

Nevada comes after Delaware as another great state for setting up an LLC. It is well-known for its lack of state income tax and very favorable business environment. The motivation behind and necessity for using Nevada to conduct the business is becoming more visible in the current environment.

No State Income Tax: Nevada does not have to levy a state income tax on LLCs so that the enterprises find it a very lucrative option for doing business.

Privacy Protection: The business owners of Nevada are allowed to form LLCs without their public records disclosing their personal information, which provides the required privacy.

Business-Friendly Laws: Nevada is known for its user-friendly business law and therefore, it is an ideal place for business owners with limited liability.

Wyoming offers the possibility to operate your business with the least possible fees and the highest level of asset protection. In essence, Wyoming is considered to have an infrequent and sound business environment in the United States.

Low Filing Fees: Wyoming has the lowest annual filing fees and minimal ongoing fees for LLCs, which makes it very affordable for startups and new businesses.

Strong Asset Protection: Wyoming having strong asset protective laws represent the conditions in which the personal assets of the owners of the company will be completely safe in the event of the company achieving the ownership.

Like Nevada, Wyoming also does not levy any state income tax, which is very advantageous for your business in the long run.

No State Income Tax: Texas, in the same vein, exempts certain LLCs from state income taxation, one of the reasons behind its success in these areas.

Thriving Economy: Texas is one of the biggest and the most diverse economies in the country, so the businessmen have all sorts of chances to trade there.

Affordable Filing Fees: Texas has moderately priced filing fees, the level of which varies somewhat depending upon state, which enables a company to keep expenses under control.

No State Income Tax: Florida is the only state that does not levy direct taxes on individuals, thus, helping business owners with reducing their tax liabilities.

Business-Friendly Environment: The State of Florida has a vibrant entrepreneurial community and provides myriad tools for small businesses to flourish.

Large Market: Florida, with a population of over 21 million people, enables businesses to have a large customer base.

Learn how to maximize your business potential by selecting the best state for your LLC. Swyft Filings offers guidance and support for your journey

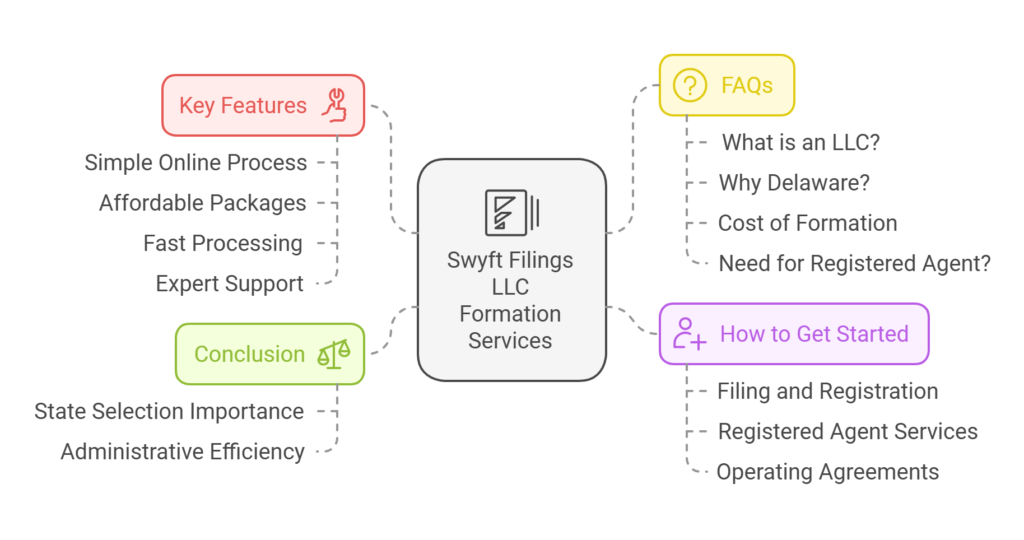

Swyft Filings is the foremost provider of online LLC formation services that has the provision of starting your LLC promptly, conveniently, and at a reasonable price. Swyft Filings, by this simple procedure and loyal customer service, ensures that your LLC will be set up without the hassle of paperwork or legal procedures.

Simple Online Process: With just a few clicks, these forms can be completed to start your LLC on the internet.

Affordable Packages: Swyft Filings in offers three pricing tiers (Basic, Standard, Premium) to meet your business requirements and your budget.

Fast Processing: Swyft Filings guarantees the fast processing of your LLC formation, in some cases, it is only one business day.

Expert Support: Their specialist teams are always ready to help and support on any questions or concerns that you might have during the formation process.

| State | State Income Tax | Annual Fees |

| Delaware | No | Low |

| Nevada | No | Low |

| Wyoming | No | Low |

| Texas | No | Low |

| Florida | No | Moderate |

| Processing Time | Privacy Protection | Asset Protection |

| Fast | Moderate | Strong |

| Fast | Strong | Strong |

| Fast | Moderate | Strong |

| Fast | Low | Moderate |

| Fast | Low | Moderate |

Setting up your LLC can be accomplished simply by visiting the Swyft Filings’ website and choosing your package. The following services comprise of LLC’s fast establishment:

Filing and Registration: Swyft Filings will take care of all the paperwork and filings for your LLC.

Registered Agent Services: Swyft Filings provides Registered Agent services, which are aimed at you following state law.

Operating Agreements: In your case, they will create a fully customized LLC Operating Agreement that will help achieve your business objectives.

An LLC (Limited Liability Company) is a business model that shelters owners from personal liability and also offers a lot of flexibility to the incentives and tax structures.

One reason Delaware companies are so attracted is its business-friendly legal environment, no sales tax, and no state income tax on out-of-state LLCs.

Swyft Filings provides three packages. The pricing starts from free for the Basic package, $199 for the Standard package, and $299 for the Premium package.

Swyft Filings can cut your processing time to just one business day for your document and this is attributed to the package that you adopted, be it groceries or the state in which you want to create your LLC.

Yes, for the most part, LLCs are required to appoint a Registered Agent who will be a prime receiver of official documents on behalf of the company.

The startup state you choose for an LLC will play a crucial role in the growth of your business. States like Delaware, Nevada, Wyoming, Texas, and Florida are the ones that have got a range of benefits for LLC formation, such as tax incentives, privacy protection, and business-friendly laws.

Formation of your company becomes faster and much cheaper, as your company can smoothly clear all the administrative procedures associated with that formation. Once you are on the right path, using the right state and the services of a company like Swyft Filings, the success is already in your hands.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.