Most of the time, the accounting software that comes to mind for many is QuickBooks. Easy to use yet comprehensive, QuickBooks is the accounting software of choice for many small & medium business that have to manage their finances sensibly. Whether you are a fresh startup on the path of growth or a mature business with expanding needs, QuickBooks is designed to scale and grow with you.

In this in-depth guide, we will delve into the notable features of QuickBooks that are critical for business persons, realistic strategies that would assist you in using the software optimally, & pros and cons of the different implementation options available.

Additionally, we’ll offer a pricing summary for the application, as well as an FAQs section to ensure any unanswered questions can be dealt with in full.

What is QuickBooks Accounting Software Ready For?

If you are looking for a financial solution that can seamlessly integrate your accounting tasks, QuickBooks is regarded among the most comprehensive accounting software available on the market. From invoices to payroll, QuickBooks brings all your financial activities in one common interface. The flexibility that QuickBooks provides is of utmost importance, as it is available as a desktop application or as a SaaS option. Because of this, businesses have the ability to choose the platform that works best for them in operations.

Another great reason to choose QuickBooks is the vivid interface and plethora of functions the program carries. It gives companies from small to large the ability to streamline processes such as data capture, financial report generation, and tax report generation with hardly any steep learning curve typical of other financial applications.

Core Features of QuickBooks Accounting Software

1. Bookkeeping & Accounting Made Simple

Accounting need not be seen as some difficult task to be undertaken with trepidation. With QuickBooks, many of the time-consuming and repetitive tasks that would otherwise have to be manually conducted day after day are now taken on by improved software technology. Using the program can generate practically any type of document, such as custom estimates or invoices besides enabling one to monitor expenditures incurred with only a few presses.

All potential financial expenses on the other side of the ledger screen may be tracked easily along with available cash flows by making these few clicks on a mouse or keyboard. Not even does QuickBooks Group present data already prepared, but they also organize them according to specific standards, thus offering real-time summaries about every part of the firm.

Automatic Bank Sync: Accurately linking whatever account with your bank will now be a problem free exercise as you can effortlessly complete this within QuickBooks. With this feature, transactions get incorporated and classified automatically saving you time you can use exploring other options.

Financial Reporting: In this world nothing can be very much possible within just several clicks, creating balance sheets or income statements among other forms of financial reporting is much enough to produce quotable insights on how ones endeavor is doing.

Customizable Invoices: Impress clients by making your invoices feel like they were made just for them. By adding your business logo colors and terms, you can send a professional-looking document that would leave customers happy with the services and consequently help enhance the couple since gaining several new clients.

2. Simplified Payroll Management

The tedious task of payroll management can now be termed traditional since with QuickBooks the process has become automated and seamless. Once all pay computations, deductions, social security taxes and federal state withholding every employee gets paid through a complex process if done manually. Utilizing this software means that one does not have to fret about whether every employee has received an accurate paycheck or if all taxes have been paid in time and correctly.

Direct Deposit: Employee’s no longer need to visit banks to collect their salaries since this tool provides seamless payments right to your bank on the agreed date. You are your employees would not have to concern themselves with stress or more waiting because all pay periods shall be observed without failure.

Master QuickBooks Accounting Software with our ultimate guide. Delve into its features, benefits, and practical tips to streamline your accounting processes.

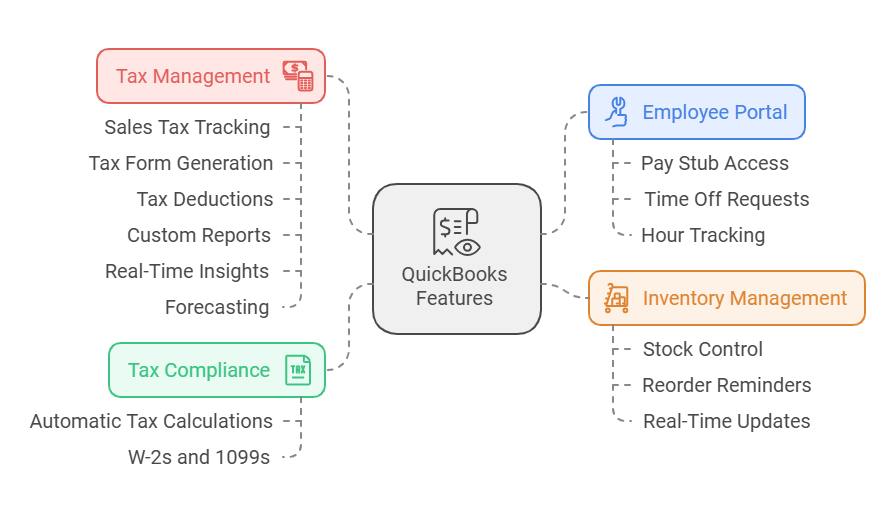

Tax Compliance: QuickBooks automatically calculates labor taxation and issues the necessary paperwork to pay taxes (e.g., W-2s, 1099s). This feature is beneficial as it provides peace of mind for business owners, knowing that they are complying with laws with such accuracy.

Employee Portal: Your employees can access their pay stubs, request time off, and even track their hours—making payroll management a breeze for both employers & staff. All of these functions are carefully designed to enhance the experience of the employees making them feel valued & secure.

3. Inventory tracking and management

For businesses that produce physical products, QuickBooks offers a powerful inventory management component. With stock control, reorder reminders, and real-time updates, you will avoid stress as all aspects of your stock control system will operate harmoniously thereby ensuring that you never run out of critical items.

Automatic inventory updates: QuickBooks will automatically adjust the inventory each time there is a sale or a delivery received thereby allowing you to have up-to-date available information in regard to the stock levels at all times.

Vendor Management: QuickBooks enables you to manage your vendor orders and payments directly from the software ensuring that you always know what’s in stock and when it is supposed to be replenished. This feature can be beneficial as it helps to maintain great relationships with suppliers as well as stay ahead of potential shortages in demand.

Reorder Points: Set minimum inventory levels to receive automatic reorder alerts when stock is running low. This helps to ensure that you never run out of critical items and can also assist you in cutting back on needless cash flows by observing your stock more accurately.

4. Effortless Tax Management

Filing taxes can be a difficult responsibility for any business owner given that it integrates many aspects which necessitate attention to details. Fortunately, QuickBooks makes this labor-intensive process much easier by streamlining your businesses’ tax management process.

Sales tax tracking: Carefully calculates the sales tax for each transaction based on your location and products sold thereby making it easy to remain compliant. This ultimate free labor feature guarantees that there will never be any discrepancies in your sales tax calculations.

Tax Form Generation: Quickly generate essential tax forms like 1099s for contractors or employees to simplify the tax filing process and further save on time. Minimizing complexity in regard to the management of taxes is something that should be done by any entrepreneur willing to run their business in a smart manner and by QuickBooks working smartly doing some of the heavy lifting as far as taxation is concerned, this is something possible for any firm that utilizes QuickBooks.

Tax Deductions: Handling deductions meticulously is what the QuickBooks software is made to do. The software performs complete tracking of your deductible claims which will guarantee you claims some of the greatest tax savings. Constant updating of expenditures is practically snagged in the net so that nobody misses any opportunity for repayment.

This feature is, therefore, useful in keeping control of a business expenses as well as its risks by helping the owners to stay a head. Furthermore, the report generation tool of the software means that business owners can now generate a report on their expenses that are admissible for tax deduction. QuickBooks makes it easy for even new employees to earn the business tax deductions.

Custom Reports: one can fabricate specifications, diagrams as well as pie charts, and set up tables, and as such QuickBooks forms work according to the requirements they have set and as well capture all the proving angles of sales, prices, income, and more. With specific reports, enterprises can enter into the minutiae and discern and act on sector trends or underlying reasons for variations in performances for business.

Real-Time Insights: With up-to-date information available in the format of up-to-date functional reports as well as dashboards, one can always remain updated about the financial status of the enterprise. No more awaiting the concurrence of month end statements: digest, act and evolve as time goes on thus available to your opposition at each turn. By means of functioning at the peak of the knowledge and transacting with customers can keep a high level of integration of the processes, making the company fast and extremely responsive in the swarms.

Forecasting: This is particularly advantageous since you can use the previous year’s records to determine the sales and costs of the following year, and this will ensure that you do not go off the rails. It’s possible to visualize the way ahead of uncertainties, and find out where theoretical earnings would be realized in specific segments of a business and when and divulge how invaluable all of these precursors are to conscientious financial management.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.