In the changing world of small business management it is crucial for every small business to always make sure that they have the right financial management documents. This can provide a strategic advantage not just a necessity that should be accomplished like everybody else’s.

This does not always come cheap as micro businesses operate with very small amounts of money but the right selection of accounting software can play a decisive role in maintaining this organization and keeping it on the right track.

QuickBooks, the brainchild of Intuit, has for quite some time been acknowledged as an industry leader offering a package of tools expertly designed to cater to the specific requirements of small businesses. The following is an extensive review of QuickBooks, looking into its efficiency in carrying out micro businesses operations and dealing with their problems.

Invoicing and Billing

When it comes to billing an invoice QuickBooks is a comprehensive accounting system that company on doing this by providing customizable templates to help. Consequently micro businesses which probably do not possess the skills of a graphic designer can always produce professional-looking invoices. Below are some main elements of the invoicing and billing features in QuickBooks for micro businesses:

– Customizable Invoice Templates: The ability to personalize invoices to match up with the identity and persona of your business is vital. Perfection in this regard improves the chances of clients responding positively to the invoices as it is said that people do not remember the details but remember the things that make them happy.

– Recurring Invoices: Constant invoicing of repeat customers is sufficient proof that one is organized and has a well-arranged system of operation. This is made even easier in QuickBooks, which automates the invoicing process for micro businesses meaning less work for employees and improved cash flows that come periodically.

– Online Payment Acceptance: In the internet world today it is present that you can give clients an option of making payments directly through their smart devices without having to travel or meet you. Having this option available in QuickBooks allows markets for payments made through PayPal or Stripe, which provide with an avenue of integrating payments done through such online means in a safe and fast way.

– Automated Reminders: Send reminders for overdue invoices, I request to consider this as a personal calling to achieve aspects of good customer care. Good accounts practice has it that reminding for payments in a convenient way that does not annoy customers, QuickBooks empowers these reminders to get sent automatically so that the owners have one less thing to remember in managing their business.

It is indisputable, and means always count down the last cent of income. In the modern technical world, QuickBooks has utilizado expense tracking facilities for micro businesses are quite progressive and pay

– Expense Reports: Generate comprehensive reports that are essential for tax purposes, as well as for closely monitoring the patterns of your business expenditures. Reports have a direct impact on the organization, and failure to generate accurate reports will result in a pretty little repetitive situation that can be avoided with these solutions.

– Company Credit Cards: Issue cards specifically for your employees, while maintaining control of the company’s finances by importing these transactions directly into QuickBooks. These credit cards allow you closely monitor and regulate cash flows while at the same time enabling your employees to settle business expenses or access to funds.

QuickBooks is highlighted by its ability to provide real-time insights into the financial health of your business. This makes it possible not only to observe the present situation but also to see the trends and take necessary actions in time.

– Customizable Dashboards: View key financial and operational metrics at a glance and track changes in the data over time. Customization options here are versatile: each user can set a dashboard suitable for him or her, with only the most important figures.

– Financial Reports: Access in-depth reports such as profit and loss statements, balance sheets, and detailed cash flow reports that can be generated in no time. It is also advisable to regularly take a look at these reports in order to assess the financial position of the organization, find weak areas that need closer attention, and thus develop strategies to improve the situation.

– Export to Excel: Export data to Excel for further analysis, manipulation, or presentation, giving you the flexibility to work with reports and figures according to your needs. Practically everyone knows Microsoft Excel, which allows for additional processing of QuickBooks data, and it is possible to create graphs and presentations by exporting some reports.

Payroll may not be a concern for all tax-paying micro businesses, but those with employees will find these features invaluable. Managing employee compensation is critical and can’t be boiled down to any simple solution.

– Automated Tax Calculations: QuickBooks handles the complicated web of payroll taxes so that you do not have to, calculating deductions, exemptions, and liabilities automatically. That helps you avoid serious problems with the tax authorities as well as to be always compliant with the legislation currently being in force.

– Direct Deposit: Pay your employees with direct deposit and experience the convenience of cashless transactions that this handy feature offers. With this option, you can automatically deposit wage payments into your employees’ accounts according to the specified pay schedule,

| Advanced | $200 | This plan includes all Plus features and offers enhanced customization, ensuring your accounting is more streamlined, workflow automation, which means less manual work, and dedicated support for your specific business needs.

Micro businesses can find sufficient and effective solutions to their accounting needs by electing either the Simple Start or Essentials plans. These plans have the necessary features including simple bookkeeping and financial reporting for the micro businesses but are also keep them within the range of small prices hence they do not become too expensive.

Read our in-depth QuickBooks review to find out why it is the top choice for micro businesses. Streamline your accounting with this powerful software solution.

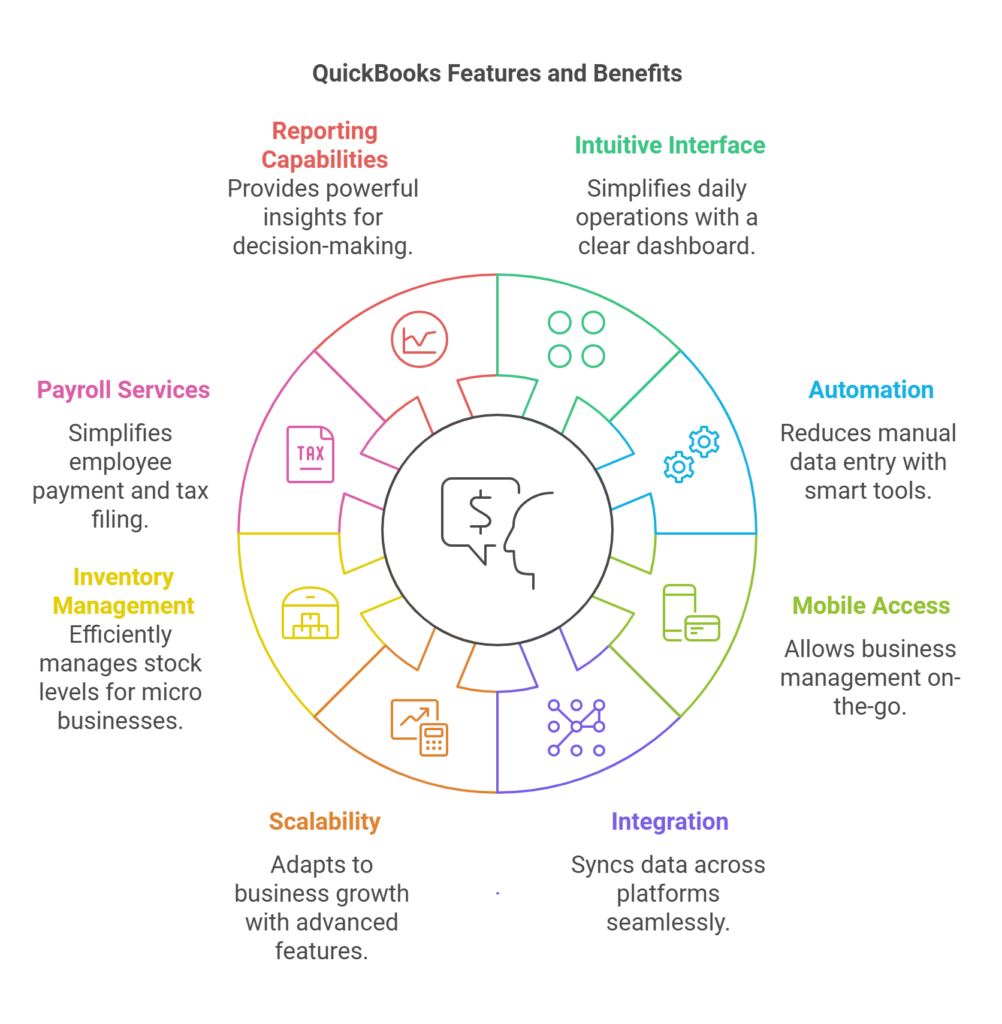

When it comes to usability features of QuickBooks, usability is taken with a lot of considerations, and it ensures that any businessman should be able to use it with ease. This is provided by the following:

– Intuitive Interface: The dashboard has a clean, professional look that concentrates the most relevant key performance indicators such as bank balances and expenses on one screen, which makes daily operations, including invoicing and payments, a simple task.

– Automation: The app incorporates many smart tools such as recurring orders and bank feeds from certain banks and countries’ banks that drastically reduce the amount of time spent on manual data input, which helps startups save time for other more basic tasks with certain automation in accounting.

– Mobile Access: Your accounting behavior as far as the proper management of your business is not the same anymore with QuickBooks quickly becoming a very handy tool as it has a mobile application that acts like a portable office.

This allows you to keep your business finances in check while on the go whether that means firing off a few invoices or using the general reporting function to find the nail in the proverbial coffin – and unlike its competitors, QuickBooks has consistently ranked high in user feedback.

Unlike its predecessors, which focused only on providing desktop solutions, QuickBooks has been redesigned to integrate seamlessly with a number of third-party applications, with a small compatible apps original count of over 200 which can be increased based on the demand of the client. It is possible for micro businesses to take this advantage and:

– Sync Data: The automation of syncing data between systems promotes the maintenance of consistency across platforms, ensuring that inventory, sales, and finance are up to date in real-time for the most accurate pictures of stock levels and future sales, and current cash flow.

– Scale: If your company reaches new heights potential, then QuickBooks is the ideal solution as it transcends its original basic model, able to include more advanced features in add-on plans available when ones needs change. This flexibility also means that those companies who

A: It is possible to access QuickBooks Online from any device that has an internet connection and therefore it provides you with convenience as you can control your business finances wherever and whenever you want.

A: Inventory management is one of the features present in the QuickBooks Plus and Advanced plans which make them ideally suitable for micro businesses that deal with any type of physical products. The method used for inventory valuation is an average cost method that enables efficient management and accurate pricing on stock products.

A: You would not lose everything as Intuit has a policy of keeping your data for one year after cancellation. This means that before you cancel your subscription you need to export or print any reports that you might need. Alternatively, if you want to retain the program you can opt for QuickBooks Desktop version private and a separate version from the Quick Books online subscription.

A: QuickBooks can certainly assist you in this aspect with respect to payroll services which are provided as add-ons to most plans. Whatever use may be required, QuickBooks surely helps make things easier with respect to paying employees at the right time, calculating taxes and filing returns required by law.

QuickBooks has a unique reputation among micro businesses for its excellent features, scalability, and ease of use. More than just being an expense tracking app, it is ideal for freelancers, retail entrepreneurs, service-oriented actors, and other micro-business owners who need technology to ensure they have the necessary tools – for budgeting, reporting, and data tracking – that will enable them to make smart financial decisions that help grow their companies or maintain stability in tough times.

With powerful reporting capabilities, easy integrations with external services, and dedicated customer support, QuickBooks is a program that genuinely helps simplify all aspects of day-to-day bookkeeping so there’s never any question about how much profit is being made or whether expenses exceed budgets.

As you’re weighing the options of QuickBooks, it is crucial to keep in mind that there are various versions and models of QuickBooks in the market to do your own thorough research about the various QuickBooks versions or models available for use. You must also make the best use of the free trials and features that QuickBooks has to offer which can help you see what the software has to offer from a cordial point of view. In addition to that, the selection of the right QuickBooks plan should be done

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.