Business management is a fast-moving, highly competitive industry. So, financial oversight has become more than obligatory. In fact, it’s now a strategic advantage. For UK entrepreneurs, correct and to the point accounting software would be the core factor that would contribute to the success of their businesses, that is, of course, gaining absolute productivity in the operation and improving the financial accuracy, thus, leading to the growth of the business.

FreshBooks is the one that shines, among many, it is the most viable option, particularly, for small businesses, freelancers, and self-employed professionals. It is a general survey of the product’s characteristics, utility, pricing, and a comparison with QuickBooks that is used.

The reputation of FreshBooks in the business world is well known. It has never experienced the negative phenomenon of company liquidation for any reason.

Among the plethora of invoicing software, FreshBooks has a competitive edge in the respect of removing hurdles of time involved in it. This is what it enables:

– Customization is possible: Without any difficulties on your part, you can mask your name in a piece of advice along with the description of the goods and services that were supplied. Also, you can set up the billing of the same customers week after week. You can enable automatic payment processing on invoices through

FreshBooks.’s mobile payment system, which offers fast payment options to customers paying immediately. By these method debt collection becomes faster and more consistent and cash flows more secured

– Online Payments: Freshbooks gives you the convenience of paying with credit cards, debit cards, PayPal, or any other digital payment channel without a merchant account. By clipping this technology on invoices, clients can pay directly and swiftly, thus improving the cash flow.

– Automated Late Fees and Reminders: Use them to schedule automatic reminder emails to late payers and charge fees as penalty for late payments.

It is the proper way to manage costs that are so sensitive to the fiscal game:

– Receipt Capture: Point the camera of your smartphone at a purchase receipt, code, and move on with your spending talks.

– Bank Reconciliation: FreshBooks connects to your bank account as well as imports statements, hence, there tends to be less human error and data entry.

Time Tracking: Record the hours worked, allocate the projects or clients, and make invoices that reflect the time spent.

Profit and Loss: Firmly set the parameters and the business strong and weak points will particularly become evident from this.

Tax Summaries: With the help of summaries, your tax return process gets simpler through accurate detail of expenses and income.

Explore our in-depth FreshBooks review, highlighting its features and benefits for UK entrepreneurs. Find out why it’s the best accounting software for small businesses.

General Ledger: Log your financial transactions with their sum and their date.-

Trial Balance: Flag the issue if your books should not balance.-

Chart of Accounts: Classify your financial data to be managed easily.

Pricing and Plans FreshBooks has four pricing plans, each tailored for a different type of company. These are:

| Plan | Monthly Price | Features |

| Lite | £15 | Unlimited invoices for up to 5 clients, expenses, estimates, VAT returns. |

| Plus | £25 | Recurring billing, client retainers, up to 50 billable clients. |

| Premium | £35 | Unlimited clients, advanced reporting, custom emails, and more. |

| Select | Custom Pricing | Tailored for larger businesses with specific needs. |

Each package includes a 50% discount for the first 6 months, rendering it a favorable choice for newcomers seeking to test the waters.

When we look at FreshBooks and QuickBooks, these are the main points of divergence:

| Feature | FreshBooks | QuickBooks |

| Pricing Model | 3 plans + custom pricing | 5 plans |

| Starting Price | From £15/month | From £10/month |

| Customer Support | AI chatbot with human agent escalation | Phone, chat, and email support |

| Bank Connections | Available for some plans | Available for all plans |

| Multi-Currency Support | Yes | Yes, for some plans |

| Payroll | Available for some plans | Available with additional fees |

| User Experience | User-friendly, designed for non-accountants | More complex, suitable for businesses with in-house accounting knowledge |

A: Yes, FreshBooks offers plans like Plus and Premium that cater to businesses with multiple clients and employees, providing features like team member management and advanced reporting.

A: Absolutely, FreshBooks is HMRC approved and MTD compliant, offering VAT return reports among other accounting features.

A: FreshBooks integrates with payment gateways like Stripe and PayPal, allowing clients to pay invoices directly online, which speeds up the payment process.

A: FreshBooks focuses on simplicity and user experience, making it ideal for non-accountants. Its automation features, like automated invoicing and expense tracking, save significant time for small business owners.

A: Yes, FreshBooks offers a 30-day free trial for all its plans, allowing potential users to explore its features before committing.

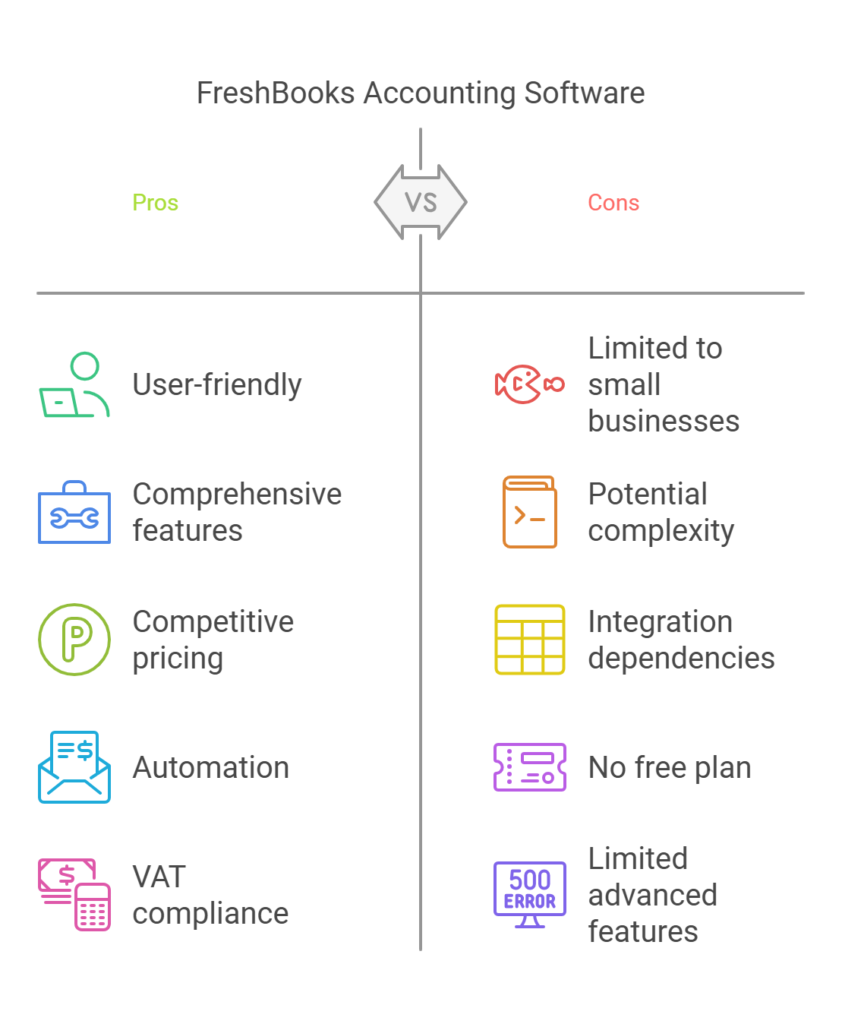

FreshBooks appears as an intuitive, user-friendly accounting solution for UK entrepreneurs, in particular, those who operate on a small scale or freelance. Its intuitive interface, comprehensive features, and competitive pricing make it an excellent choice for those looking to streamline their financial management without getting bogged down by complexity.

Whether you just started or are in the market for an upgrade from the basic system, FreshBooks offers the tools necessary for the efficient management of your finances, thus there is no need for you to spend more time on accounting than on your business development.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.