Starting a business is an exciting venture, and one of the first steps in that journey is deciding on the best state to form your LLC (Limited Liability Company). The state in which you form your LLC can have a significant impact on your business’s long-term success.

Factors such as taxes, registration fees, and regulations can vary greatly depending on the state you choose. In this article, we’ll guide you through the process of choosing the best state for your LLC formation, with a focus on how Swyft Filings can make this process easier, faster, and more efficient.

When you create an LLC, you are essentially choosing the legal environment in which your business will operate. States have different rules and regulations concerning business formation, including filing fees, tax structures, and privacy protections.

This means that the best state for your LLC formation depends on your specific business needs, your budget, and your long-term goals.

For example, some states like Delaware, Nevada, and Wyoming are popular among business owners because of their favorable business laws and tax benefits. However, depending on your business’s physical location and operational scope, it might make more sense to form your LLC in your home state. Understanding the pros and cons of each state will help you make an informed decision.

Now, present the quality revision that follows the specified rules, with the content format remaining the same,

Swyft Filings is a business formation-focused online service. They help entrepreneurs to set up an LLC, corporations, and other types of businesses in the United States by guiding them through the user-friendly platform of the website and ensuring that the formation process is efficient and accurate.

Whether you are a beginner or you are expanding to states, Swyft Filings can provide expert advice and services that are specifically suited to your demands. Here is a concise scientific explanation of the process:

Besides doing the LLC formation, Swyft Filings provides registered agent services, compliance monitoring, and other essential business services to make your company’s operation remain good.

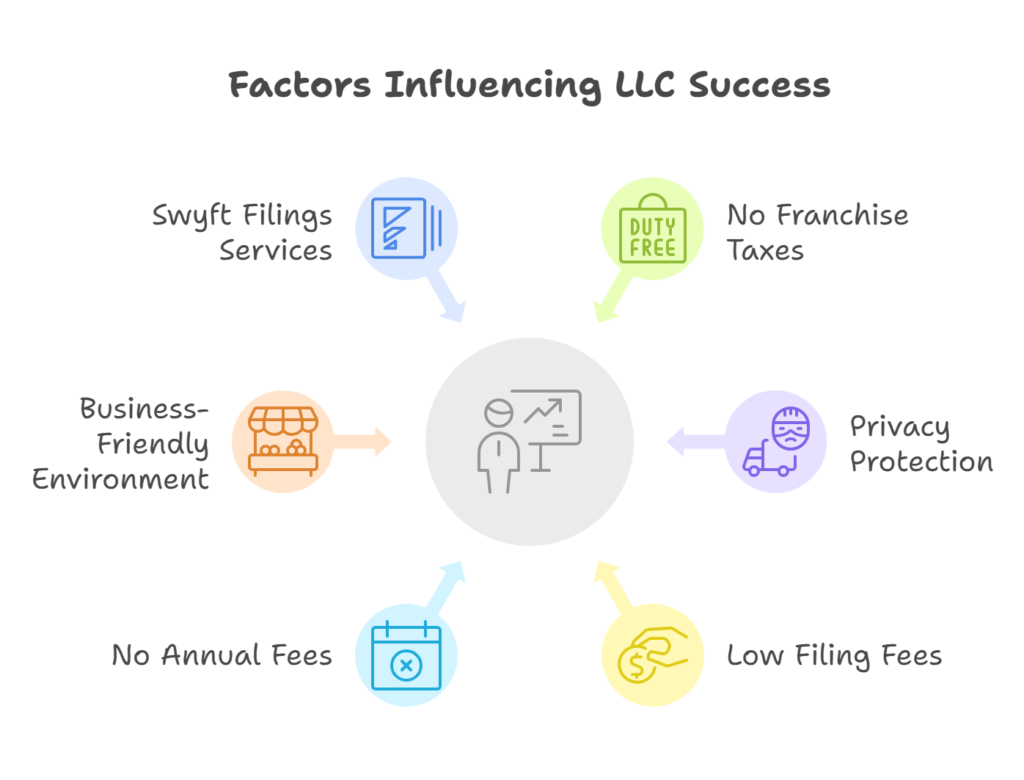

The decision of which state to form your LLC in is influenced by several factors. Here are the main ones:

One of the significant factors that you should consider in forming your LLC is state taxes. States like Delaware, Nevada, and Wyoming are famous for their flexible tax regulations, such as no state income tax. These states may be suitable for you if you want to take advantage of the tax benefits. However, you should be aware that tax laws are complicated, and it is your business structure that will define your particular tax obligations.

Each state sets its own registration fees for LLCs. Some states offer low filling fees, while others can charge a higher amount for LLC formation and maintenance. Additionally, some states have annual fees or franchise taxes that will need to be considered when budgeting for maintaining your LLC in the future.

If privacy is a very important issue for your business, some states offer to the LLC members’ privacy protection more comprisable than the others as a matter of fact. For instance, Delaware privileges members and directors with the right not to be exposed in public records that makes it interesting for those who value secrecy.

States like Delaware are the ones that are going to be mentioned as states with the best laws for business formation. Delaware boasts of its established Court of Chancery which takes care of corporate cases and this is a main reason why it is highly demanded by businesses seeking certainty and protection in legal matters.

In the event that your business will have a physical existence or work mainly in a specific state, you may choose the easier route of forming your LLC in that state rather than another. For instance, if your company is situated in California, it would be more practical to file your LLC in California, rather than Delaware, since you will still be legally required to do it in California.

Anyway, whether your business is new or not, we will now look at, among other things, the most popular states used for LLC formation including the factors.

Delaware is believed all over the place to be the best state for forming LLCs, particularly big businesses, and corporations. The state offers several key advantages:

In the case of LLCs that do not run outside the state, Delaware does not charge a state income tax. It is for this reason that it becomes a viable candidacy for firms that operate in multiple states.

Delaware has a clear legal system for businesses. The Court of Chancery is highlighted for dealing with business disputes effectively, so it closely follows the law while maintaining the interests of larger businesses.

Privacy

Delaware allows LLC owners to stay hidden, as most other states do not offer such a strong level of protection.

Nevada is another favorite state for LLC formation due to the beneficial tax system it offers:

In the same way, Delaware, the state of Nevada does not impose the state income tax on business people, meaning that you can save a substantial amount of money.

Learn about the top states for launching an LLC with Swyft Filings. Our strategic guidance helps you navigate the complexities of business formation effectively.

Nevada doesn’t have LLC pay any franchise taxes, giving this company an advantage of saving the money they owe the franchise tax which would be a plus for business owners.

Nevada allows LLC owners to stay low profile and thus privacy for those who chose such a way to work.

Wyoming prides on its great environments for businesses and the lowest possible costs:

Wyoming does not impose a statewide income tax on LLCs, also providing an incredible option for the owners who want to.

Wyoming has some of the lowest filing fees for LLC, which makes it one of the most reasonable choices for new entrepreneurs.

Like Nevada and Delaware, Wyoming also allows LLC members to be listed as anonymous persons in public records.

New Mexico is often being neglected from the many states with a chance for owners of LLC to save money, among some other advantages:

New Mexico is relatively cheaper in LLC formation costs, making it a perfect choice for entrepreneurs.

In many states llc companies are asked to pay annually, New Mexico is the opposite, and no payments are required, which makes it a very affordable choice for business owners.

Florida is a popular destination for LLC formation, especially for businesses that are looking to start their operations there:

Florida does not have any state income tax that state throwing you out of the tax statements is good news for it.

Florida’s vivacious business culture, gives both the new and the old firms in it a better place for the conducting of their businesses.

Breaking into the population of 20 million people, Florida is the third most populous state after California and Texas. To provide access a large customer base in Florida may be very appealing for the growth of the business in the stage.

| State | Filing Fee | State Income Tax |

| Delaware | $90 | None (if out of state) |

| Nevada | $75 | None |

| Wyoming | $100 | None |

| New Mexico | $50 | None |

| Florida | $125 | None |

| Franchise Tax | Privacy Protection | Notable Advantage |

| Yes (annual) | High | Business-friendly legal framework |

| None | High | No franchise tax |

| None | High | Low filing fees and privacy protection |

| None | Medium | No annual fees |

| Yes (annual) | Medium | Large market and business-friendly |

Swyft Filings now provides unfussy LLC formation process that hardly takes any time compared to the previous ones in the old world. Their platform is a guide who never leaves your side and helps you choose the right state, complete your filing, and even stay compliant with state regulations. Swyft Filings offers extra services such as:

This service is a legal requirement in most states. Swyft Filings acts as your registered agent and thus assures that your company is in full compliance with the local rules and regulations.

Swyft Filings can assist you in drawing up an operating agreement, a key tool for defining your LLC structure and operations.

Swyft Filings tracks key dates such as filing annual reports to prevent your LLC from being penalized by the state.

An LLC (Limited Liability Company) represents a business structure that shields the personal assets of the owners and at the same time offers tax benefits.

Yes, you can form an LLC in all the states. Nonetheless, in order to do that, you might have to avow as a foreign LLC in your resident state to do business there.

On the one hand, Delaware has put a beneficial system that by the time of 2021 there are no tax returns for LLCs multi-state out of the state tax. The other benefit is about advising protection, creating a slightly weaker tie for privacy and a sustainable business system.

Swyft Filings changes by adding the service to the lower costs while filing LLCs that start at $0.00. Additionally, is other servicesness like the registered agent & express shipment that will come with an extra charge.

Be it the company’s fate or fortune, choosing a state becomes crucial in the success of your business. The state among the fifty states where firms are new or relocating that offer the least taxes, protective measures, and ease of incorporation at the lowest cost is the one that you need to choose.

Swyft Filings is a deeply inspiring process by providing professional guidance and a variety of economical alternatives for the start-up company.

Whether you form a Delaware LLC or start a business in Nevada, Wyoming or some other place, Swyft Filings will direct the path of your business towards success.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.