Running a business that is not very large can be a delightful experience, but handling it can be very challenging. An aspect that no business owner can do without is precise financial recordkeeping. Many small business owners manually handle their account at first but this usually becomes too much as the business begins to grow. This is the way that accounting software such as FreshBooks work.

Throughout this article, these are the topics we will cover: the needs for accounting software for small businesses, how it can improve your business process, and why FreshBooks is the best option you can choose for your financial management.

Why Do Small Businesses Need Accounting Software?

1. Simplifies Financial Management

Financial management can be as easy as one, two, and three if you use accounting software. Using a specific tool gives business owners who may not have any training in accounting the necessary instruments to track income, expenses, taxes, and so on. In just a few seconds, you can create, and send invoices, track payments, and generate financial reports through your FreshBooks account.

2. Saves Time

No more entering the data by yourself into the spreadsheet since the software does these operations automatically. FreshBooks’s automates redundant tasks such as invoicing, time tracking, and expense classification. This gives you a chance to use your time to work on a strategy for growing your business rather than do repetitive administrative work.

3. Ensures Accuracy

It is unavoidable for humans to make errors when calculating manually. Accounting software provides the accuracy of financial reporting and also cuts down the probability of high-cost mistakes. FreshBooks through its effective error checking on financial reports, which are of utmost importance while filing taxes and business loans, is ideal for your company.

4. Improves Cash Flow Management

Cash flow is the lifeblood of any small business. Freshbooks will help you monitor the pending payments from your debtors, and the collected payments from your creditors, thus, you will always be able to tell at what point your company is financially. Having real-time information at your disposal is a strategic advantage for you, as you will be able to make better financial decisions, plan for future expenses, and avoid going down with no money.

5. Tax Compliance

Abiding by tax regulations is among the major challenges of any business especially to small business owners who are not tax law savvy by any means. Freshbooks, the tool which is one of the best examples of technology in tax preparation, keeps track of your income and expenses, classifies them accordingly, and then generates reports that can actually be handed over to the accountant at tax time.

6. Increases Professionalism

If you use accounting software like FreshBooks, your business will be perceived as more professional by not only clients but also the investors and other stakeholders. Issuing well-arranged invoices and scrutinizing documentation skills have played an important role in building trust and credibility.

Key Features of FreshBooks for Small Businesses

1. Invoicing and Payments

The first time you use FreshBooks, you will be able to send neat and stylish invoices to your clients with a click of a button. You can also customize the invoice by adding your business logo, terms, and conditions for full payment, as well as by setting up automatic payment reminders. FreshBooks supports online payments which means your customers can make payments directly via the invoice.

2. Time Tracking

In case your business has billable hours, FreshBooks is the right tool for you because it has a time tracker that is very user-friendly and enables easy project time control. You have the option of either the time tracker tool to count the hours while you work or the manual method of entering the time later on. The software is able to auto-generate invoices that have been based on the tracked time, thus your clients will pay you the correct amount for your work.

3. Expense Tracking

In order to remain profitable, it is necessary to check expenditure. FreshBooks lets you scan the receipts and also classify the expenses by project or clients with ease. Thus you are able to track your spending, and in this manner, you end up making wise financial decisions.

4. Financial Reporting

FreshBooks provides versatile reports such as the Profit & Loss summary, Tax Summary, and Sales Tax. These reports demonstrate how your business’ performance is in terms of the financial aspect, thus making tax filing easier.

5. Project Management

By utilizing FreshBooks, you can manage several projects at the same time. Besides, you can assign tasks, monitor project budgets, and cooperate with your team to complete them in real-time. Hence it becomes simpler to be organized and meet deadlines for projects.

6. Multi-User Access

FreshBooks lets you provide access to your team or accountant so they can be a part of your business’s finances as well. You can control user permissions, only allowing those who are authorized to access the sensitive financial data of the company.

Learn why FreshBooks is essential for small businesses. Optimize your accounting processes with user-friendly tools for invoicing, expense tracking, and reporting

Advantages of Using FreshBooks for Your Small Business

1. Easy to Use

FreshBooks has been specifically designed with its users in mind making it a very user-friendly application. It is not necessary for you to be an accountant to use it. Even if you have no prior experience with accounting software, Freshbooks makes it simple to set up and navigate.

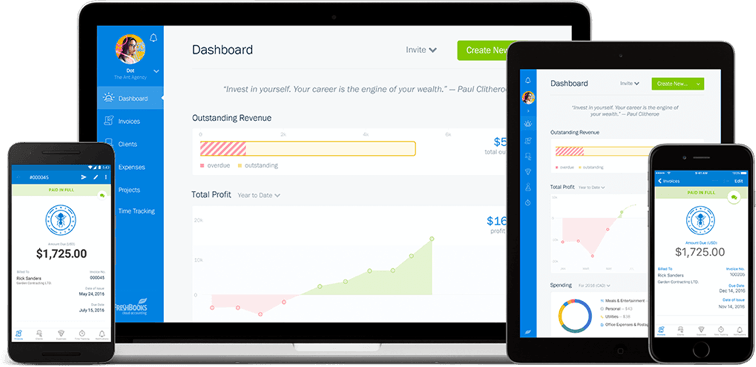

2. Cloud-Based

Cloud-based software enables you to access financial data anywhere at any time as long as you have an internet connection. Whether you’re at home or traveling for business, your data is within reach.

3. Affordable Plans

FreshBooks offers different pricing plans to meet the needs of both large and small businesses. no matter if you are just starting out or have already been in the business line, you can find a plan that meets your needs. FreshBooks even offers a 30-day free trial so you can test out the features before committing to a subscription.

4. Secure

Data security is one of the main areas of attention for FreshBooks. The software takes your financial data by means of encryption and keeping it secure. FreshBooks will grant you the peace of mind that all the valuable information of your business is protected from cyber attacks.

5. Customer Support

Freshbooks offers fantastic customer support via its live chat option, whereby customers are able to communicate with the customer service agent either through the chat interface, email, or phone. Their support team is there to aid you in resolving any problems that may arise while you are using the application.

Is FreshBooks Right for Your Small Business?

Freshbooks is a perfect fit for entrepreneurs who are getting started and need an intuitive system that’ll help them keep their financial records in order. Besides, it helps small businesses that are operating online to manage the finances easily. It is most useful in the cases of freelancers, consultants, and service-based businesses who are the primary customers. Itineraries and additional accounting are some of the possible tasks that might come up. you need to look at other options for this type of task. Nonetheless, FreshBooks is loaded with practical tools that are simple to use for daily bookkeeping and cash flow maintenance.

Comparison Table: FreshBooks vs. Manual Accounting

| Feature | FreshBooks | Manual Accounting |

| Invoicing | Professional templates, auto reminders | Time-consuming, error-prone |

| Expense Tracking | Upload receipts, categorize expenses | Requires manual entry |

| Time Tracking | Automatic, track billable hours | Manual entry, easy to forget |

| Financial Reporting | Profit & Loss, Tax reports, etc. | No automatic generation |

| Cloud Access | Accessible from any device | Not accessible remotely |

| Collaboration | Multiple user access with permissions | Limited or no collaboration |

| Tax Preparation | Automatic reports for tax filing | Time-consuming, error-prone |

Pricing Plans for FreshBooks

FreshBooks offers various pricing tiers to accommodate businesses of all sizes:

| Plan | Price per Month | Features Included |

| Lite | $15 | 5 clients, invoicing, expense tracking, and reporting |

| Plus | $25 | 50 clients, time tracking, project management, and invoicing |

| Premium | $50 | Unlimited clients, advanced reporting, and team collaboration |

| Select | Custom | Custom solutions for large businesses, with additional support |

How to Get Started with FreshBooks

Getting started with FreshBooks is quick and easy. Simply sign up for a free trial, and you’ll be guided through the setup process. You can import existing financial data from spreadsheets or other software, or start fresh with FreshBooks’ built-in tools. Once you’ve set up your account, you can begin using features like invoicing, time tracking, and expense management right away.

FAQ

1. Do I need accounting software if my business is small?

Yes, even small businesses benefit from accounting software. It saves time, reduces errors, and helps you stay organized and compliant with tax laws. FreshBooks is a great choice for small businesses due to its user-friendly interface and essential features.

2. Can FreshBooks help me file my taxes?

You are not able to file your taxes with the help of FreshBooks. However, it assists you in a big way by producing reports you can send to your accountant. These reports include income, expenses, and taxes, so your accountant is able to file your tax return in the correct and quick way.

3. How much does FreshBooks cost?

There are several pricing plans available through FreshBooks with the one that costs $15 per month. Depending on the business size and requirements, you will be able to choose the right plan for you. In addition to that they offer a 30-day free trial so you can see the features for yourself before deciding to go with a monthly plan.

4. Is FreshBooks easy to use for someone with no accounting experience?

It’s true that FreshBooks is a user-friendly and intuitive tool. In fact, anyone can begin using it without any of the accounting knowledge that would be required for a more sophisticated system, thus, it is excellent for the small business owners who have practically no experience with accounting.

5. Can FreshBooks handle multiple businesses?

Indeed, FreshBooks allows you to do many businesses through the same account. You can switch between businesses with ease and their accounts will be handled separately.

6. Does FreshBooks integrate with other software?

FreshBooks definitely has that feature. FreshBooks interfaces with various third-party applications like PayPal, Stripe, and Zapier so you can automate tasks and streamline your workflow.

Conclusion

To conclude, programs like FreshBooks are really essential to small businesses. It is worth noting that this software makes the process of financial record keeping and reports, as well as the time for tax compliance, very simple. By automating tasks and providing financial analysis, FreshBooks in a way, small firms can easily focus on key business areas.

Forward ones’ business is what really matters. If you are a freelancer, a consultant, or a solo service-based business owner, FreshBooks can be a strong and affordable tool that will help you elevate your financial management.

Discover thesaasifyhub.com, where we specialize in reviewing essential SaaS products like GetResponse and FreshBooks. Our mission is to assist you in finding the best digital tools to streamline your operations and drive growth. Let’s explore together!

Welcome to thesaasifyhub.com – where SaaS meets simplicity. Our journey began with a simple mission: to make the world of SaaS accessible, understandable, and beneficial to everyone. We dive into products like GetResponse, QuickBooks, FreshBooks, CuraDebt, and AppSumo, cutting through the noise to deliver honest, insightful reviews.

© 2024 TheSaasifyhub, All right reserved.